Mar 1, 2024

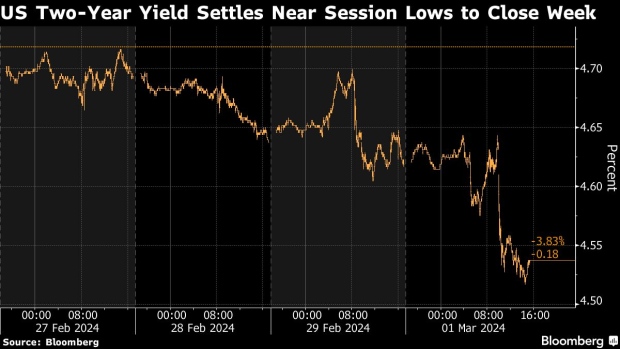

Treasury Yields Extend Slide Fueled by Weak Data, Fed Comments

, Bloomberg News

(Bloomberg) -- US bond yields were near session lows in late US trading after weaker-than-expected economic data and comments by Federal Reserve officials in support of slowing the pace at which it’s shedding Treasury securities from its asset portfolio.

The two-year note’s yield fell as much as 10 basis points on the day to 4.52%, the lowest level since Feb. 15. It drew 4.69% in an auction on Monday. Longer-maturity yields declined less. The rally overrode bearish sentiment that had gripped the marker earlier in the day, based in part on a contrarian forecast that the Fed won’t cut interest rates this year.

Yields reached the lowest levels of the day after a large block trade in Treasury five-year note futures at a price consistent with a purchase. However, the bulk of the move occurred earlier in the session, when weaker-than-anticipated data was followed shortly by comments by Fed Governor Christopher Waller in support of slowing the pace at which Treasury securities are rolling off its balance sheet.

“We’ve seen a lot of buying today,” said Andrew Brenner, head of international fixed income at Natalliance Securities LLC. “There’s been a lot of information that has led to better rates,” including economic data and Waller’s comments.

Treasuries began the day with gains against the backdrop of a collapse in the shares of New York Community Bancorp that stoked concerns about US regional banks’ real estate exposure. The gains briefly faded as US equity index futures recovered early in the session, and following a prediction by Torsten Slok, chief economist at Apollo Management, that economic growth and inflation won’t allow the Fed to cut interest rates this year.

Fed officials’ most recent quarterly forecast in December was for three quarter-point cuts this year, and the bond market has embraced that view, based on the prices of swap contracts that reference future Fed meeting dates. But growth and inflation have slowed less than most people expected after 11 Fed rate increases over the past two years, and officials have an opportunity to revise their forecasts next month.

Interest-rate strategists at Bank of America said in report that the risk of a signal for fewer rate cuts this year had risen because policymakers are likely to increase their forecasts for the economy and inflation.

Data released Friday clashed with that view though. The ISM manufacturing report for February was weaker than economists predicted, and included the second-lowest employment gauge in recent years. And the University of Michigan’s consumer sentiment gauges for February were revised lower. On the labor market front, the US government’s February employment report is slated to be released March 8.

Fed Governor Waller said he favored a shift in the Fed’s holdings toward a larger share of short-term Treasuries. During the same event, Dallas Fed President Lorie Logan reiterated her view that it’ll likely be appropriate for the central bank to start slowing the pace at which it shrinks its balance sheet as the quantity of reserves in the banking system declines.

Their comments “may have helped move rates lower,” said Gennadiy Goldberg, head of US interest-rate strategy at TD Securities. Treasuries outperformed swaps Friday, suggesting “that the market thinks the end of QT is nigh.”

--With assistance from Edward Bolingbroke and Alexandra Harris.

(Adds comments, context and chart and updates yield levels.)

©2024 Bloomberg L.P.