Apr 5, 2024

Uranium Stocks Soar on Bullish Goldman Sachs Call, Kazakhstan Flooding

, Bloomberg News

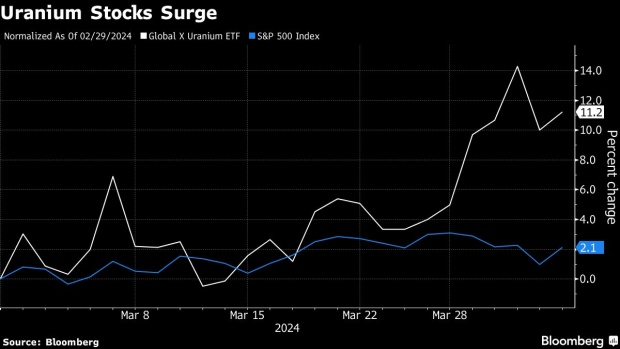

(Bloomberg) -- Uranium stocks are having their best run in months on a combination of flooding in Kazakhstan, the world’s largest producer of the nuclear fuel, and a burst of bullish coverage from banks including Goldman Sachs Group Inc.

The sector has been a bright spot for energy investors, with uranium spot prices jumping some 40% over the last year as the world’s largest miner, Kazatomprom, has struggled to lift production and as the US considers a ban on Russian supplies. The supply concerns have cropped up as countries around the world are turning back to nuclear power as a way to cut emissions.

But this week, the stocks saw an added influx of demand. The $3.2 billion Global X Uranium ETF rose about 6%, for its best week since early February. The fund has benefited from gains in NuScale Power Corp., a nuclear power company trying to build small modular reactors, and small-cap miners including Mega Uranium Ltd. North America’s largest uranium miner, Cameco Corp., climbed 14% this week after Goldman initiated it with a buy rating.

The latest advance in the uranium ETF gained steam early in the week as reports of flooding in Kazakhstan boosted shares of competing miners, and following Goldman’s April 1 call on Cameco. Goldman analyst Neil Mehta said global uranium demand could grow by as much as 60% by 2040.

“Goldman’s initiation opens the whole universe up,” said Michael Alkin, chief investment officer at Sachem Cove Partners. He started his fund, which invests in uranium miners and also in physical uranium, in 2018, at a time when he said the sector garnered little attention.

Now, he said, investors are looking past the handful of larger, established miners and turning their attention to mid-sized or exploration companies. Sachem Cove, which owns shares of Cameco and Denison Mines, has also backed small-cap Premier American Uranium through its initial public offering in 2023. That stock is up almost 70% this year.

Analysts are also debuting coverage on a wider range of uranium stocks, including those of companies that have yet to build their first mines. Scotia Capital introduced coverage of NexGen Energy Ltd. on April 1 with an outperform rating. The company is in the process of developing Canada’s next uranium mine.

“Despite capacity restarts, we forecast the uranium market to remain in a multi-year structural net deficit position, due to massive planned reactor build in China and the dual Western world agenda of decarbonization and energy independence,” Scotia analyst Orest Wowkodaw wrote.

(Closes shares.)

©2024 Bloomberg L.P.