Jul 28, 2022

US Slowdown Puts Economy on Path to Ever-More-Likely Recession

, Bloomberg News

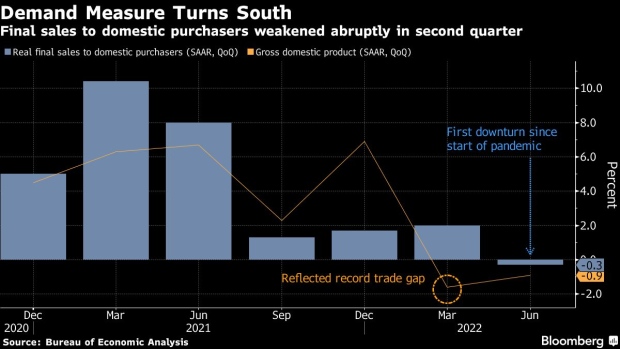

(Bloomberg) -- The US economy is losing momentum heading into the back half of the year, highlighted by the government’s latest report card that showed weaker consumer spending and declines in business and residential investment.

While the economy shrank for a second straight quarter -- meeting one rule of thumb for a recession -- economists and Federal Reserve Chair Jerome Powell are skeptical, largely due to a strong labor market. Still, odds of a downturn, possibly as soon as yearend, are mounting as households and companies succumb to the weight of decades-high inflation and rising interest rates.

“Based on the available data, we believe broad activity is not yet consistent with a contraction that is typically thought of as recession,” which instead would start early next year, Wells Fargo & Co. economists Tim Quinlan and Shannon Seery said in a note. However, “it is undeniable that the economy is cooling,” they said.

Second-quarter gross domestic product fell an annualized 0.9% after a 1.6% drop in the first three months of the year, according to Commerce Department data Thursday. Inflation-adjusted consumer outlays decelerated to the slowest pace in two years, residential investment fell the most since the onset of the pandemic and business spending cooled.

The report followed a decision by Fed policy makers on Wednesday to raise their benchmark interest rate by another 75 basis points as they try to put the hammer down on inflation at a 40-year high.

Chair Jerome Powell reiterated the Fed’s resolve to bring inflation down but acknowledged that such an effort may stymie the recovery. While achieving a soft landing is still the goal, it’s “gotten more challenging” in recent months, he said.

Back-to-back quarters of declines in GDP defines a recession in most parts of the world, but in the US it’s not official until economists at the National Bureau of Economic Research deem it so.

Nonetheless, the breakdown of the GDP data suggests the economy will be fragile through the rest of the year. Several economists still see the economy growing in 2022, but the combination of persistent inflation, aggressive Fed tightening, market volatility and weakening demand are daunting hurdles.

“While we continue to see a pathway to a softish landing, it’s admittedly narrowing,” Oxford Economics’ Lydia Boussour and Kathy Bostjancic said in a note. They see real GDP growing 1.9% this year.

Providing essential fuel for the economy is one of the strongest-ever labor markets, with unemployment forecast to stay near a 50-year low in July amid solid hiring and a near-record number of job openings. Jobless claims dropped last week and continuing claims, which measure Americans applying for ongoing benefits, are also near historic lows.

Some of the strength, however, is showing signs of fading as more companies lay off workers due to economic uncertainty. And while applications fell, they’ve generally been rising and sit around the highest since November.

What Bloomberg Economics Says...

The contraction in second-quarter GDP significantly raises the risk that the economy will fall into recession by year-end. Even if two consecutive quarters of negative growth don’t necessarily satisfy the official NBER definition of recession, lagging momentum leaves the economy vulnerable to further adverse shocks such as a potential energy crisis in Europe or intensified supply strains in the second half of the year.

--By Yelena Shulyatyeva and Eliza Winger, Bloomberg US economists

To read the full note, click here

Amplifying the risks is a fraught geopolitical landscape as Russia’s war in Ukraine continues and sinks the euro-zone economy, while leaving supply chains in disarray. Russia is clamping down the continent’s energy supplies, escalating an ongoing cost-of-living crisis.

That might be what tips the US economy over the edge, according to Bill Adams, chief economist at Comerica Bank.

“Another negative shock like an energy crisis in Europe this winter would be enough to push the US into a recession,” Adams said.

©2022 Bloomberg L.P.