Apr 12, 2024

Wall Street Sees Fewer T-Bills Sold in April as Tax Season Boosts US Cash Pile

, Bloomberg News

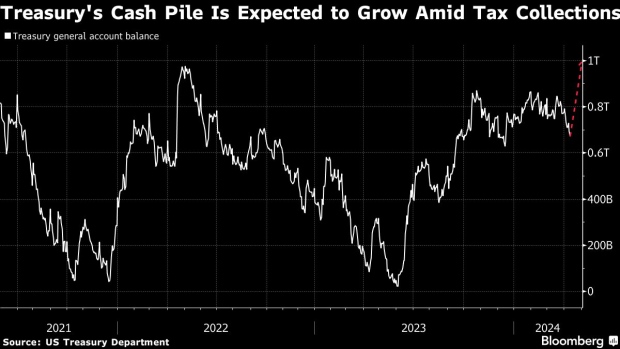

(Bloomberg) -- Wall Street strategists are expecting the Treasury to shrink its monthly cache of bills even more as the government’s cash pile swells with tax receipts pouring in.

The annual rush to pay Uncle Sam means the Treasury doesn’t need to issue as much short-term debt as in other months to fund the US government. The total amount collected this season is expected to be higher than in prior years due to higher incomes and a booming stock market. The department has already paid down about $149 billion of bills since the end of March, data show.

Barclays Plc expects supply to drop by another $150 billion, according to its quarterly forecast, with the Treasury General Account peaking at around $1 trillion by the end of the month. JPMorgan Chase & Co. strategists see an additional $116 billion reduction in T-bill supply over the coming three weeks, with risks of even larger reductions. It previously expected a $131 billion drop in short-dated government debt for all of April.

“There are downside risks to these forecasts, as we might be underestimating the strength of upcoming tax receipts amid tight labor markets and strong asset performance last year,” JPMorgan strategists led by Jay Barry wrote in a Thursday note to clients.

Two years ago, the Treasury collected nearly $600 billion in tax revenues due to an exuberant stock market and a powerful economic recovery, according to government figures. Those payments are deposited in the TGA, which functions like the government’s checking account at the central bank.

While the Treasury usually starts lifting the size of bill auctions by June once the cash is spent, larger-than-expected tax collections can actually result in years with less supply. In 2022, Treasury’s bill supply shrunk by about $540 billion between March and July, according to data.

Read More: Tax Deadline Is Pivotal for Funding Markets, Fed’s Balance Sheet

Through the end of March, the Internal Revenue Service processed about 1% fewer returns than at the same point in 2023, according to Barclays strategist Joseph Abate. Corporate taxes are running 15% to 20% above their 2023 pace and withheld taxes are about 3% higher than during the previous year, a reflection of a stronger labor market and higher wages.

JPMorgan expects the bulk of individual receipts to be filed in the four days around April 15, which would align with the period between April 11 and April 17. That’s because electronic filings represent a growing share of total tax payments, and the IRS has become more efficient at processing non-electronic returns.

©2024 Bloomberg L.P.