Sep 17, 2022

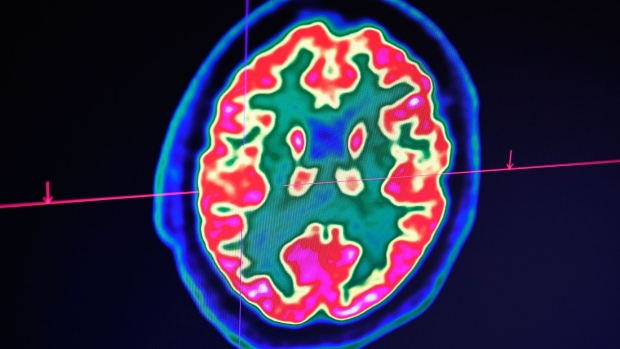

Bluebird’s Gene Therapy for Brain Disease Receives Accelerated Approval

, Bloomberg News

(Bloomberg) -- Bluebird Bio Inc.’s shares fell Monday after US regulators approved its gene therapy for a brain-wasting disease with a warning about cancer risks and under the condition that the drugmaker can show that it works long term.

Bluebird will charge $3 million for the treatment, Chief Executive Officer Andrew Obenshain said in an interview, the highest-ever US price for a drug. It’s a one-time treatment for children living with cerebral adrenoleukodystrophy and will be sold under the brand name Skysona.

The FDA granted what’s known as an accelerated approval. It allows Somerville, Massachusetts-based Bluebird to introduce its gene therapy under the condition it provides long-term data to prove the treatment’s benefit, according to a company statement.

The shares fell 10% as of 12:02 p.m. in New York. They’d lost more than a third of their value this year through Friday’s close.

Drug companies charge high prices for gene therapies because unlike other drugs, they are given once for conditions that often have few good treatment options. Some drug makers have offered money-back guarantees to make the prices more palatable. For another gene therapy that was approved in August, Bluebird said it would reimburse payers up to 80% of the cost if it didn’t work within two years.

But Bluebird said it wouldn’t offer that type of refund for Skysona. The company said in an email that the “rarity and complexity” of the brain-wasting disease would make such a program “extremely challenging to implement.”

Rare Genetic Condition

Skysona, also known as eli-cel, treats a rare genetic condition that afflicts young boys and can cause rapid deterioration and death. Until now, the only treatment available for cerebral adrenoleukodystrophy, also known as CALD, was a stem-cell transplant from a sibling or a matched donor.

With 70% of patients diagnosed with CALD not having a matching donor, eli-cel could significantly improve the lives of patients. The therapy was approved for boys between the ages of 4 and 17 regardless of whether they have a match.

The company had sought a full approval of the treatment, but it became clear in conversations with regulators the accelerated pathway was the best option, Obenshain told Bloomberg on Friday. While data from a late-stage trial showed promising results in the treatment’s efficacy, at least three patients who received eli-cel developed cancer of the bone marrow. Trials were paused in August 2021 because of safety concerns. The hold was lifted last week in conjunction with the approval.

The drug comes with a boxed warning about cancer risk.

In June, a panel of expert advisers to the FDA unanimously voted in favor of the treatment, saying the benefits outweighed the risks. However, the panel stressed the need for aggressive monitoring of patients after they are treated.

Cash Boost

Skysona’s clearance marks Bluebird’s second approval within a month, infusing fresh hope into a company that recently warned it might run out of money. Bluebird plans to sell priority review vouchers it received from the FDA upon the two approvals, which it estimates could fetch around $110 million each.

Read More: Bluebird Sees Road to Revival After Gene-Therapy Misfires

With only about 40 patients diagnosed with CALD each year, Skysona represents Bluebird’s smallest commercial opportunity.

In comparison, the company estimates more than 850 people could be eligible to receive its Zynteglo gene therapy for the blood disorder beta thalassemia.

(Updates with stock move in first paragraph, details on pricing throughout.)

©2022 Bloomberg L.P.