Sep 16, 2023

California Dreamforce, Autoworkers Strike: Your Saturday US Briefing

, Bloomberg News

(Bloomberg) -- Hello from San Francisco, which just got a boost from an estimated 43,000 Dreamforce conventioneers hosted by Salesforce CEO and hometown billionaire Marc Benioff. The city was noticeably spruced up and the hope is that more companies will consider staging their big meetings here. Conference spending remains far below pandemic levels — just $587 million in 2022 compared with almost $2 billion in 2019, according to the San Francisco Travel Association.

Steve Case might not be visiting SF anytime soon. If the billionaire co-founder of media giant AOL had his way, more tech companies would base their headquarters away from Silicon Valley and traditional venture capital centers like New York and Boston. While several big companies have relocated to Texas, the startup scene has been less recognized in places like Dallas, said Case, who has invested in more than 200 companies nationwide through his company Revolution.The S&P 500 had a lackluster week, slipping 0.2% to close at 4,450. It’s still around 16% higher in the year-to-date, unlike the Dow Jones Industrial Average, which has gained an anemic 4.4%. The S&P has benefited from the tech sector’s all-consuming strength, but beyond a small corps of AI winners, big swaths of the market remain unconvinced the US economy is going anywhere.

It’s not just the makers of weight-loss drugs like Ozempic that are benefitting from the medications’ surge in popularity. Syringe makers and drug distributors are among the winners from the boom. Here’s a stock investor’s guide to the opportunities.

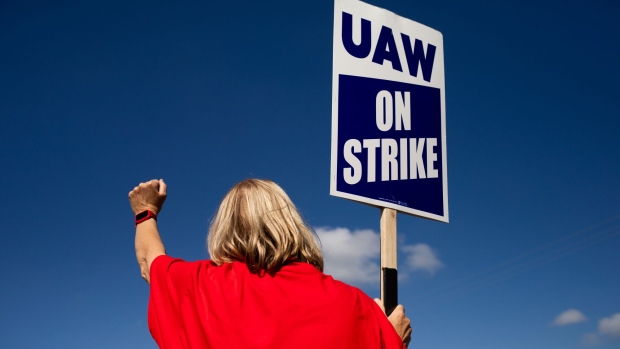

The United Auto Workers began a strike against the Big Three carmakers, an unprecedented move that could launch a costly and protracted showdown over wages and job security. After exchanging harsh words on the first day of the walkout, the two sides will be back to the bargaining table today. The union has about 150,000 members at GM, Ford and Stellantis, and they want a share of the huge increase in corporate profits since their last contract was signed. GM CEO Mary Barra said her company’s latest offer — 20% raises over four years, cost-of-living allowances and boosts to existing pensioners — was the best in its 115-year history. “I am extremely disappointed and frustrated,” Barra said Friday. “This is a strike that didn’t need to happen.”

Oil bigwigs including Exxon’s CEO and the Saudi energy minister are getting together in Calgary to hash out the industry’s future. There’s much at stake. The meeting’s theme, “Energy Transition: The Path to Net Zero,” will probably get some pushback from executives concerned about the security of global energy supplies who want to increase oil drilling. Still, keeping energy affordable and shareholders happy need not come at the expense of the environment, says Richard Masson, chair of the World Petroleum Council in Canada and one of the organizers of this year’s meeting.

There’s a UN General Assembly meeting in New York next week, though you’d be hard pressed to find a theme members could rally behind. Rarely has the organization seemed so helpless to address the most pressing global issues. Many countries are starting to look elsewhere to do something about it, Bloomberg’s Iain Marlow writes.

Prices of luxury condos on New York City’s Billionaires’ Row have fallen, but you might not want to call the movers just yet. A penthouse along Central Park that listed for $250 million can be yours at a 22% discount, while a duplex in the same building had its price cut 15% to $149.5 million. Homes with “aspirational pricing” often sell for even less, said Jonathan Miller, president of appraiser Miller Samuel Inc. Many have found buyers when sellers were willing to accept price cuts of around 60% to 70% of their original asking price, he said.

And on that note, enjoy the rest of your Saturday. We’ll be back tomorrow with a look-ahead to the coming week.

©2023 Bloomberg L.P.