Sep 25, 2023

Chief of LG Electronics Backs EVs to Drive New Chapter of Growth

, Bloomberg News

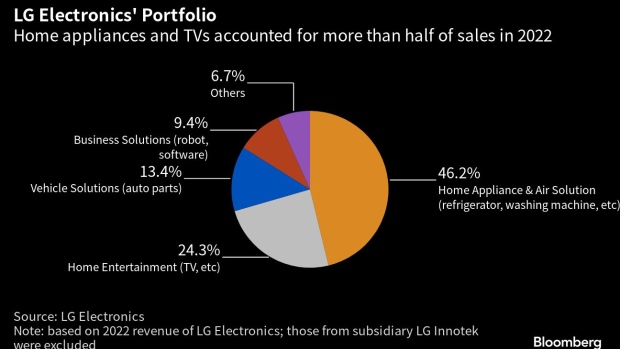

(Bloomberg) -- One of the world’s leading home-appliance makers is looking to electric vehicles to help boost its growth, specifically infotainment systems and components that are used in cars.

South Korea’s LG Electronics Inc. aims to generate $17 billion in annual sales from its so-called vehicle solutions business by 2030, accounting for about 20% of total revenue, up from 14% in the first half of 2023, according to Chief Executive Officer William Cho. That will make it the company’s main growth engine, he said in his first media interview since taking the helm in 2021.

“I’m confident that the company will be one of the top players in the mobility industry,” Cho told Bloomberg News.

“We are going to focus on what we do well,” he said, pointing to what he described as LG’s deep understanding of consumers and ability to respond to evolving technologies. LG doesn’t intend to make its own EVs.

Cho is attempting to transform the 65-year-old electronics behemoth into a company that embraces digitization, electrification and services linked to its devices. LG aims to spend at least 50 trillion won ($37 billion) on new businesses by 2030, according to a long-term strategy published in July.

The transition will help LG’s diversification from thinner margin, capital-intensive hardware operations, particularly as inflation and worries about recession dent demand for electronics.

LG is already a significant player in vehicles, with $80 billion in outstanding orders for technology such as e-powertrains, Cho said. It counts General Motors Co. and most carmakers in North America and Europe as customers.

Cho deflected questions on whether LG is in talks with Apple Inc. for a potential partnership on EVs, saying it’s something he is often asked. “We are confident and ready to cooperate with current and future automakers,” he said.

LG Magna, a partnership with Canadian auto parts manufacturer Magna International Inc., is integrating hardware and software, including advanced driver assistance and entertainment systems, the 60-year-old said.

Challenges include fallout from geopolitical tensions involving China and Russia, as well as competition from Chinese rivals such as Haier Smart Home Co. LG has also in the past been affected by Chinese boycotts of Korean products.

While there has been a “little bit of a strain from the supply chain point of view,” LG has no plan to “intensively shift Chinese production” to other regions for now, Cho said. “Like many other global companies, we are closely monitoring the current geopolitical situations.”

Read More: China Sees Korean Giants Retreat as Lockdowns, Tensions Bite

LG’s shares have risen about 20% this year.

According to Bloomberg Intelligence analysts including Ignacio Canals Polo, softer consumer sentiment and a weak housing market have created a “perfect storm” for appliance makers in China. Companies such as LG will need to step up innovation, advertising and investment, they said.

Cho said competition from Chinese peers is growing in lower-end appliances and televisions. A goal for LG is to dominate both premium and cheaper electronics, and generate revenue with services connected to those devices.

“We need to continuously lead the industry,” Cho said.

--With assistance from Emily Yamamoto and Nikita Koirala.

(Updates with comment from Cho and share price. A previous version was corrected to remove a reference to LG Magna unveiling a concept car at CES.)

©2023 Bloomberg L.P.