Jul 29, 2022

China’s Property Loans, Mortgages Grow at Weakest Pace on Record

, Bloomberg News

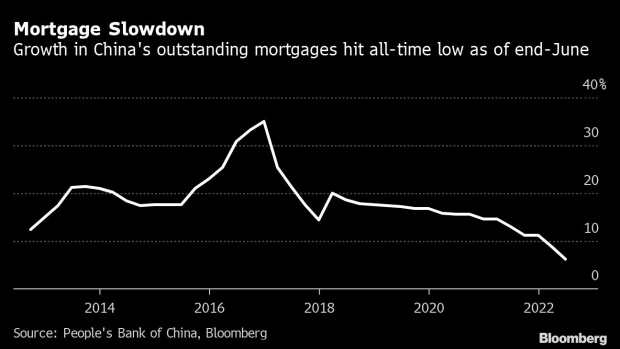

(Bloomberg) -- China’s overall property loans rose at the slowest rate on record as of the end of June, as banks were cautious about lending to cash-strapped developers while household demand for mortgages was weak amid a continued market downturn.

Outstanding loans to the property sector increased 4.2% from a year ago to 53.1 trillion yuan ($7.9 trillion) as of the end of June, according to data from the People’s Bank of China. The growth rate was down from a 6% gain as of the end of March and marked a new low in data going back to 2009.

The lending included 38.9 trillion yuan in total mortgages extended to individuals, which was 6.2% higher than a year ago, PBOC’s figures showed. That was the weakest rate since comparable data began in 2012. Loans for property development shrank 0.2% on year.

The slowdown came as housing prices fell for the 10th straight month in June, suggesting the government’s relief measures were unsuccessful in curbing the country’s spiraling real-estate crisis. The problem is further deepened by the refusal by hundreds of thousands of homebuyers to pay mortgages on stalled housing projects.

Chinese financial regulators have urged banks to boost lending to builders to help finish the projects, while the Politburo, the Communist Party’s top decision-making body, at a key meeting Thursday vowed to maintain real-estate market stability.

©2022 Bloomberg L.P.