Dec 29, 2023

Cocoa’s Biggest Gain Since 2008 Is Bad News for Chocolate Consumers

, Bloomberg News

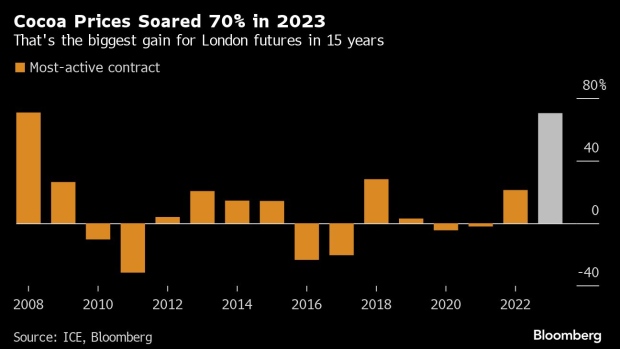

(Bloomberg) -- Cocoa’s biggest annual gain in 15 years is bad news for chocolate consumers around the world.

The surge in prices is likely to hit shoppers even harder next year as chocolate makers run out of supplies purchased at lower levels and begin to account for the brunt of the rally. White sugar futures capped a fifth annual gain, adding to the inflation in the sweets aisle.

Relentless rain earlier in the year hampered cocoa crops in West Africa and promoted the spread of a pod-withering disease. To make matters worse, an annual windy stretch known as the harmattan has now started, adding to the production threats in the world’s top growing region.

The supply worries sent the most-active contract in London up 70% this year to £3,506 a ton — the biggest yearly gain since 2008. The most-active contract traded as high as £3,588 on Dec. 18.

Read More: Chocolate Is Pricier Everywhere as Cocoa Pods Rot in West Africa

Cocoa’s supply concentration leaves little leeway for alternate growers to fill the gap. Some 60% of output comes from just two countries — Ivory Coast and Ghana. Others, like Brazil and Ecuador, are seeking to expand, although it can take several years for new trees to bear pods.

The rally is also notable for bucking the downturn across other staple crops. The Bloomberg Agriculture Spot Index is down 14% this year, the most in a decade.

While the seasonal dusty winds setting in could help fieldwork progress, the weather pattern known as El Nino risks exacerbating the dry spell.

In the near-term, lower demand could help cool prices. Still, Rabobank has forecast London futures to stay above £3,000 a ton until the second half of next year, a historically high level. Buyers in the European Union are also gearing up for new deforestation regulations that are set to add to costs throughout the supply chain.

Cocoa futures in New York are up more than 60% this year, heading for the biggest gain since 2001.

--With assistance from Celia Bergin and Ilena Peng.

©2023 Bloomberg L.P.