Jun 13, 2022

Etsy investors risk more pain after record selloff

, Bloomberg News

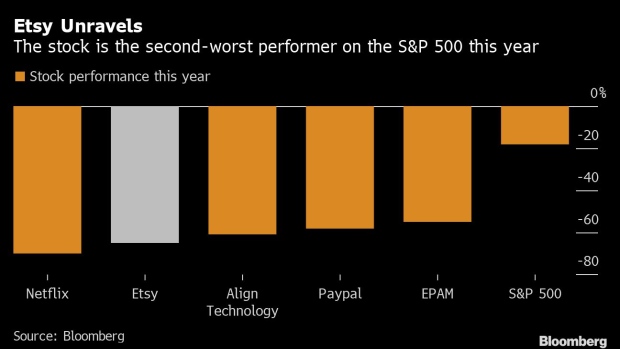

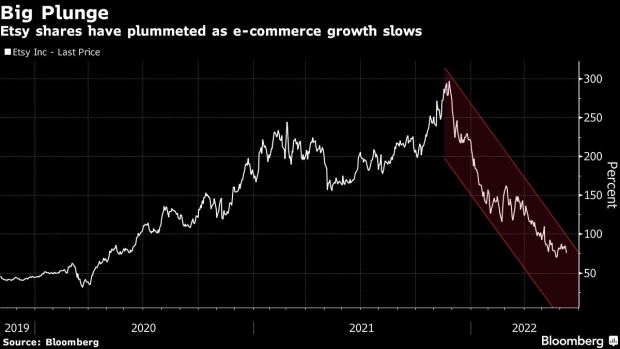

Etsy Inc.’s bad news for investors goes beyond the 65 per cent plunge that’s the second-biggest in the S&P 500 Index this year: The unraveling of the platform for craft sales may have further to go, especially with the fastest inflation in 40 years crimping consumer budgets.

With Etsy shares already near their cheapest on record, UBS Group AG slashed its price target by 50 per cent this month, while Morgan Stanley said Wall Street’s earnings estimates for the second half might still be too high. The boost in online sales from the pandemic is fading, said Ken Leon, director of equity research at CFRA.

“Etsy is facing a behavioral shift away from sheltering at home and having abundant time at home to buy personal items,” he said.

Etsy is heading for the biggest annual stock decline in its seven years as a listed company. Yet the shares are still 71 per cent higher than their 2019 closing level, while other e-commerce companies like Shopify Inc. are back to their pre-COVID prices as shoppers, who were already returning to their pre-pandemic habits, tighten their purse strings amid higher prices.

After years of double-digit revenue increases, Etsy’s sales growth is forecast to slow to 9.7 per cent in 2022, according to data compiled by Bloomberg. That data point alone could spark an exit at a time when investors stand ready to punish companies that don’t deliver blowout results and strong forecasts.

“Earnings revisions for a large portion of our e-commerce coverage may have just started,” said Morgan Stanley analysts led by Lauren Schenk. “Thus most stocks likely have not bottomed.” Schenk said in a report last week she remains cautious on Etsy, which helps merchants sell handmade crafts and vintage items, and furniture retailer Wayfair Inc., and questioned the durability of their growth given the weak economic environment.

Etsy’s shares are relatively cheap at about 3.5 times projected sales, versus a five-year average of 7.7 and the 2016 record low of two, and analysts are still bullish, giving it 15 buy recommendations and six holds. That may not be enough to lure investors given the slowdown in online commerce.

E-commerce stocks have slumped this year as the most recent earnings season laid bare the quickly fading pandemic-driven boom because of surging inflation and concerns of a recession that are weighing on consumers. Amazon.com Inc. triggered a historic rout after reporting a weaker-than-expected revenue forecast in April, Shopify’s merchandise volume and revenue for the first quarter failed to meet analyst expectations, Wayfair’s loss was wider than projections and EBay Inc. gave lackluster sales and profit outlooks.

Shopify’s U.S.-listed shares and Wayfair have plunged more than 70 per cent in 2022, and EBay and Amazon are each more than 30 per cent lower.

While analysts have begun chopping away at their profit estimates and price objectives for Etsy, the stock has been falling even faster: Their targets now imply an 88 per cent rally over the next 12 months -- or another round of price target and ratings reductions.

Tech Chart of the Day

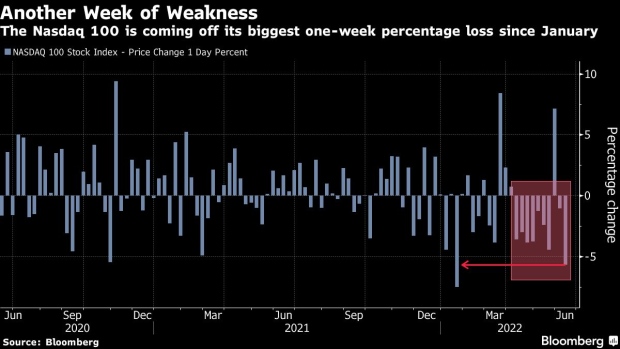

The weakness in big tech is showing no signs of stopping. The tech-heavy Nasdaq 100 Index fell 5.7 per cent last week, its biggest one-week drop since January, as well as its ninth negative week of the past 10. Much of the slump came in Friday’s session, when a higher-than-expected reading on inflation sparked a broad-based decline, taking the index down more than 3.5 per cent.

Top Tech Stories

- Crypto lender Celsius Network Ltd. paused withdrawals, swaps and transfers on its platform, fueling a broad cryptocurrency selloff and prompting a competitor to announce a potential bid for its assets.

- When Shutterfly decided recently to move the database where it clusters reams of customer photos to the cloud, one name was noticeably absent from its list of potential providers: Oracle Corp. Businesses are opting to align with newer providers such as MongoDB Inc., Databricks Inc. and Snowflake Inc. instead of Oracle, the sector stalwart, as a result of changes across the enterprise technology landscape.

- For the past quarter century, the meteoric rise of the digital economy has been exempt from the kind of tariffs that apply to trade in physical goods. That era may come to a screeching halt this week as a handful of nations threaten to scrap an international ban on digital duties in a game-changing bid to draw more revenue from the global e-commerce market.

- Contemporary Amperex Technology Co. Ltd., the world’s biggest maker of batteries for electric cars, has kicked off an A-share private placement that could raise about 45 billion yuan (US$6.7 billion), according to terms of the deal seen by Bloomberg News.

- Changpeng Zhao, co-founder and chief executive officer of the world’s biggest crypto exchange, thinks the crypto winter is a great time to increase investment in talent and acquisitions.

- Blake Lemoine, a software engineer on Google’s artificial intelligence development team, has gone public with claims of encountering “sentient” AI on the company’s servers after he was suspended for sharing confidential information about the project with third parties.

- A Chinese education company staged a meteoric stock-market rally of as much as 100% Monday as the company’s endeavors into livestreaming e-commerce went viral.

- French billionaire Patrick Drahi is mulling his next steps with BT Group Plc as UK rules that prevent him from launching a takeover offer expire on Tuesday.