Sep 13, 2022

Goldman Sees Fresh Pain on Wall Street as Real Rates Rise

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc.’s Christian Mueller-Glissmann has a simple takeaway for clients on that latest inflation shock: Wall Street’s bad year is set to get worse.

According to the managing director of portfolio strategy and asset allocation, a behind-the-curve Jerome Powell is now under even greater pressure to ramp up inflation-adjusted interest rates in order to cool the hot business cycle -- threatening fresh damage for cross-asset portfolios.

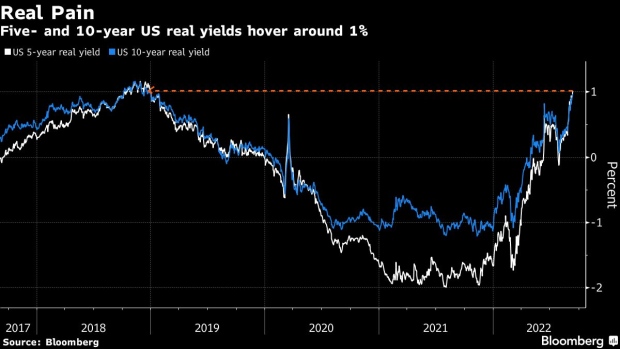

All that suggests valuations for pretty much everything bar the US dollar have scope to tumble further given the Federal Reserve is hellbent on pushing real yields even higher after a 10-year benchmark briefly topped 1% on Tuesday. That level, last seen in 2018, looks set to materially constrict economic growth ahead.

While the Fed is likely happy that the bond market is finally heeding its hawkish message, it’s another matter for investors in a slew of rate-sensitive investing strategies from technology stocks and gold to crypto.

“The high and sticky inflation increases the risk that more central bank tightening might be required, which could mean even higher real yields,” said Mueller-Glissmann. “This would put further downward pressure on valuations across assets, especially if those higher yields increase growth risks.”

The consumer price index increased last month by a higher-than-expected 0.1% from July, after no change in the prior month, Labor Department data showed. Right on cue, money managers dumped assets from tech shares to long-maturity corporate bonds, with the Nasdaq 100 tumbling suffering its worst rout since March 2020.

Bets that next week’s Fed rate move will be another three-quarters of a percentage point increase are now virtual locks. Following the report, Goldman Sachs’ economists doubled their December rate-hike forecast to 50 basis points and now predict a 75 basis-point one in September.

The relationship between stocks and higher real rates is well established, with the latter translating into lower price-equity multiples, other things being equal. At the same time assets lacking income streams -- like speculative stock trades -- look less appealing in theory, given the greater opportunity costs to hold them compared with cash positions or a Treasury bond that may pay out a real return eventually.

“There are very few assets that do well with rising US real yields due to the Fed fighting inflation, outside of the dollar,” Mueller-Glissmann said. “In the near-term this means continued elevated volatility for equities.”

To be sure, real rates may have already started to do the Fed’s bidding by discouraging over-stretched consumers and companies from borrowing while tempering the housing boom. That all suggests the Fed will be quietly cheering the new level, a very different course from 2018, the last time real rates were so high.

Back then, the surge in real rates drove policy makers to abandon their tightening campaign as part of Powell’s infamous “pivot” from quantitative tightening on “autopilot.” They halted rate hikes shortly thereafter.

Read more: Markets Need a Less Rosy View of Inflation News: John Authers

Forward-looking investors are less cheerful.

“There’s a risk that high inflation and rising interest rates could slow economic growth, tipping the U.S. and other major economies into recession,” Richard Flynn, managing director at Charles Schwab UK, said following the inflation report. “For now, company earnings remain strong. However, investors may follow company earnings particularly closely in the second half of this year.”

©2022 Bloomberg L.P.