Feb 13, 2023

Here’s What to Watch in January’s Inflation Report

, Bloomberg News

(Bloomberg) -- The path to price stability sought by the Federal Reserve is likely to be bumpy, with Tuesday’s US consumer inflation report expected to show costs rising briskly from the prior month.

Not only is the consumer price index seen rising 0.5% in January, the most in three months and bolstered by higher gasoline prices, the government’s report will also reflect a variety of dynamics beyond the closely watched headline inflation figures. The data will encompass both recently updated weightings for categories as well as methodology changes.

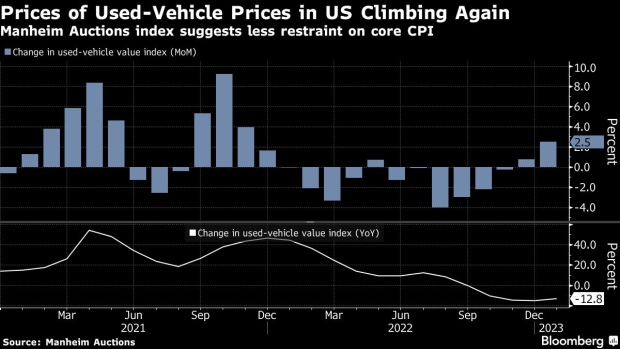

More stable used-vehicle prices — a key driver of recent goods disinflation — may help deliver another sizable gain in the core CPI. The so-called core price gauge, which offers a better sense of underlying inflation because it excludes food and energy, is seen advancing 0.4% for a second month.

That would also match the average increase over the previous six months, after annual revisions by the Bureau of Labor Statistics. Those revisions showed slight but notable upward adjustments to the overall CPI and core measure in the closing months of 2022.

Figures that show lingering price pressures on the heels of a blow-out January jobs report will heighten concerns of persistent inflation, and corroborate recent comments from Fed officials that further interest-rate hikes are likely forthcoming.

“If we have a labor market that just refuses to break and if we now have inflation that’s starting to accelerate, then I think that really increases that likelihood that the Fed just keeps going,” said Aneta Markowska, chief financial economist at Jefferies LLC.

Fed Governor Michelle Bowman on Monday said the central bank is “still far from achieving price stability” and will likely have to keep boosting rates. The tight labor market continues to put upward pressure on inflation, she said at a conference.

Here’s what you should know ahead of the January CPI report:

New Weights

A key part of the CPI calculation is how the basket of goods and services is weighted. In other words, what share each category — say food or housing or apparel — represents in the overall index. These weights will now be updated on an annual basis using consumer expenditures data to try to more accurately capture Americans’ spending habits.

Starting with the upcoming report, the BLS will use weights that reflect expenditures data collected throughout 2021 with some adjustments for rapid price changes in the last year.

The updated weights, which were released Friday, showed owners equivalent rent was adjusted up and will now account for a little over 25% of the CPI, while used cars and trucks were lowered.

Used Cars

A key explanation for the projected gain in January core inflation is used cars. Economists’ expectations range from a smaller decline in the price index for previously owned vehicles to a potential gain. That’s a notable change from 2% declines in November and December. The used-car index hasn’t increased since June.

For perspective, used cars subtracted roughly 0.1 percentage point from the monthly advances in the core CPI in the last three reports, said Veronica Clark, an economist at Citigroup Inc.

Wholesale used-car prices are now rising, according to data from Manheim. That suggests the government’s used-vehicle index may soon move beyond stabilization and instead start adding to inflationary pressures once more.

Inflation, while still high, has eased in recent months with the help of smaller gains or outright retreating prices for goods. Yet a potential shift in that tide risks thwarting progress on further reducing overall price pressures.

“Core goods in terms of a driver of disinflation is losing steam,” said Anna Wong, chief US economist at Bloomberg Economics. “There’s certainly more upward risk of a faster re-acceleration of inflation than I previously thought.”

Service Sector

The biggest services component — shelter — likely remained a key driver of inflation in January. And a methodology change to correct the undersampling of single-family rentals, Morgan Stanley economists warn, is poised to give a boost to the owners’ equivalent rent component.

Eventually these measures should cool to reflect the housing market downturn and a cooling in the rental market, but there’s a substantial lag between real-time changes and the BLS rent metrics.

Central bank officials, aware of that lag, are more concerned about a measure of services prices that strips out energy and housing. Their preferred measure is based on the personal consumption expenditures price index, but the CPI also offers some insight into how a tight labor market is impacting wages and inflation.

Prices in non-shelter services will be “just as strong if not a little bit stronger,” Clark said. She highlighted a likely rebound in airfares, which have declined in six of the last seven reports.

A jobs report earlier this month that showed employers added about half a million jobs in January, led some central bank officials to argue a higher peak for interest rates may be needed.

The CPI is “not the only game in town anymore in terms of dictating what the Fed is doing,” said Justin Weidner, a US economist at Deutsche Bank AG.

--With assistance from Augusta Saraiva.

(Adds Fed’s Bowman comments in seventh paragraph)

©2023 Bloomberg L.P.