Oracle Has More Office Workers in California Than Texas After Moving Headquarters

Three years after Oracle Corp. moved its headquarters to Texas from California, Chairman Larry Ellison said he’s planning another move — this time to Nashville.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Three years after Oracle Corp. moved its headquarters to Texas from California, Chairman Larry Ellison said he’s planning another move — this time to Nashville.

Nuveen Real Estate is seeking to sell a Miami office building located in the heart of the Brickell neighborhood with tenants including Bank of America Corp. and Apollo Global Management Inc.

WeWork Inc. and its major financial backers including SoftBank Group Corp. have struck a new restructuring deal to get the ailing workspace provider out of bankruptcy, spurning a competing financing proposal from co-founder Adam Neumann.

The majority of Canadians aspiring to buy a home say they will push their plans to next year or later to wait for interest rates to drop, a new survey shows.

China Vanke Co. recorded a second consecutive quarterly loss, adding to the developer’s financial woes as it struggles with slumping sales and a cash crunch.

Aug 25, 2023

, Bloomberg News

Mortgage data from Canada’s two biggest banks are painting a picture of homeowners straining under high borrowing costs.

Royal Bank of Canada, the country’s largest lender, disclosed that 43 per cent of its Canadian residential mortgages had an amortization period of longer than 25 years, as of July. That’s up from 40 per cent a year earlier, and just 26 per cent in January 2022.

Canadian banks have allowed customers to stretch payments for longer periods to help them bring down their monthly payments after a rapid rise in rates. Unlike in the U.S., it’s difficult for homeowners to lock in their rates for long periods. Most either have mortgages where the rates are fixed for one to five years, or variable-rate mortgages that reset with every move in the central bank rate.

That has meant higher payments for millions of borrowers after the Bank of Canada lifted its policy rate by 475 basis points in less than 18 months. RBC’s posted rate on variable mortgages is now above 7 per cent, from around 2.5 per cent before the central bank began tightening.

The situation has also brought about the return of mortgages that are amortized for more than 35 years. At the start of last year, those didn’t exist in RBC’s Canadian mortgage book; now, such loans represent 23 per cent of the portfolio.

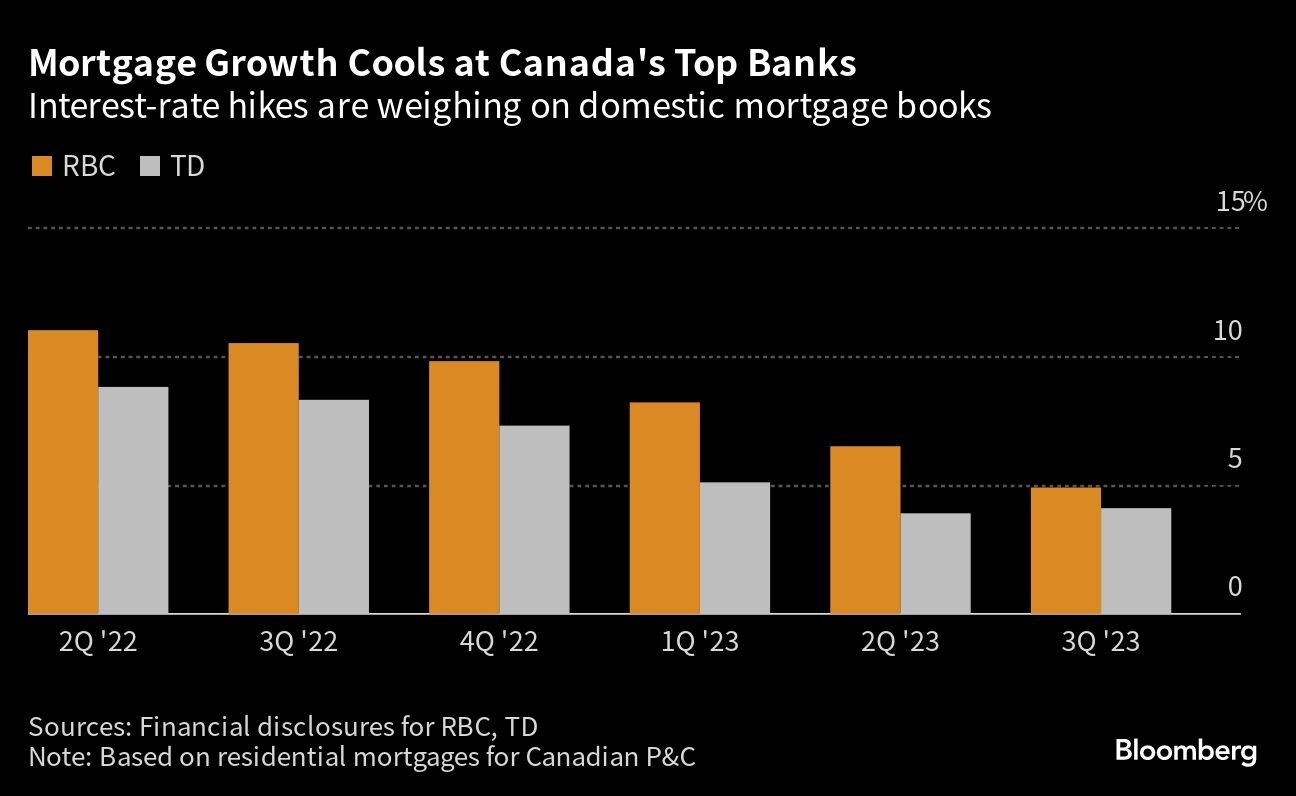

Growth in mortgages, meanwhile, has slowed.

Toronto-Dominion Bank said 48 per cent of its Canadian mortgages had an amortization period of more than 25 years as of July, up from 35 per cent the year prior. Like RBC, it has experience a surge of loans being extended to more than 35 years.

In a conference call with analysts Thursday, Michael Rhodes, Toronto-Dominion’s head of Canadian personal banking, said the bank reached out to stretched borrowers who hit their so-called “trigger rate,” or the point where their payments on variable-rate mortgages may no longer cover interest.

Toronto-Dominion offers those customers options such as lump-sum payments, increased term payments and the option to switch to fixed rates.

The Bank of Canada raised its benchmark overnight rate to 5 per cent in July, the highest level in more than two decades.