Apr 12, 2024

JPMorgan Sees Risk of High-Grade Demand Pullback if Yields Climb

, Bloomberg News

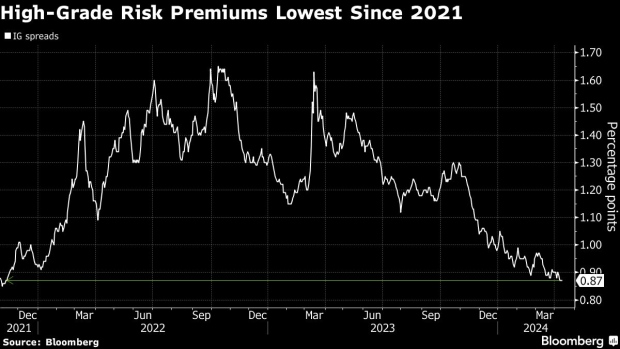

(Bloomberg) -- Climbing US high-grade yields may cause investors to move out of the asset class, even as risk premiums remain at the tightest levels in over two years, according to JPMorgan Chase & Co. analysts.

Investment-grade spreads are hovering near 87 basis points, the lowest since 2021. They’re trading tight compared to the S&P 500, investment-grade CDX and muni spreads, JPMorgan analysts led by Eric Beinstein wrote in an April 12 note.

The investment-grade market is already starting to show early signs of concern. The spread on the investment grade CDX, a key risk gauge which rises as credit risk increases, widened 2.09 basis points to 54.9 as of 11:17 a.m. New York time to the highest on an intraday basis since Feb. 13. And just 36% of US high-grade corporate bonds sold this week rallied in the secondary market compared to 84% last week, as faster-than-expected US inflation drove yields higher.

If yields continue to increase, causing total returns to become negative, investors may rethink their strong demand for high-grade bonds, the analysts wrote, referring to JPMorgan’s indexes. Geopolitical risks, especially “potential responses from Iran to the bombing in Damascus,” could also cause some volatility in fund flows and investor demand, they added.

Blue-chip bonds have returned negative 2% month-to-date and negative 2.4% year-to-date, according to Bloomberg index data.

“Historically, when gains or losses in HG bonds are +/- 2.5% over a three-month period this has caused fund flow trends to shift,” the analysts wrote. “Investors add when returns are strong and reduce demand when they are negative.”

(Adds broader market context in third paragraph.)

©2024 Bloomberg L.P.