Jul 10, 2023

Oil edges lower after its biggest weekly gain since early April

, Bloomberg News

Based on insider buying signals, natural gas stocks might have an even better H2 than H1: Researcher

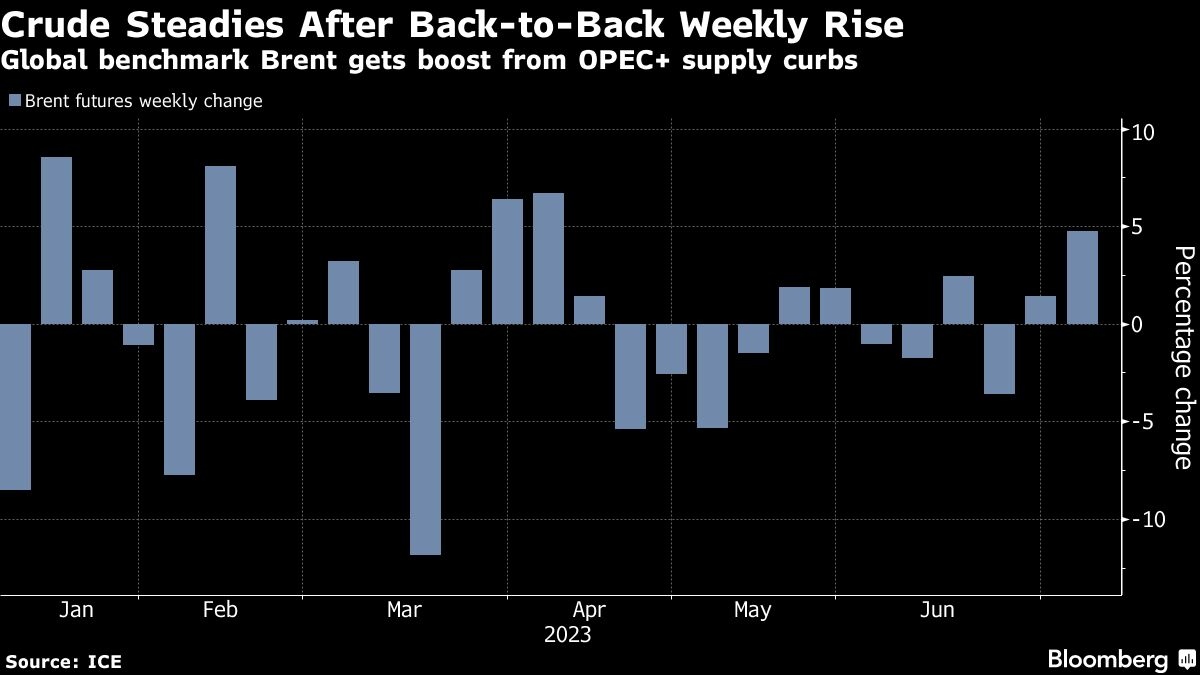

Oil dipped, eroding its biggest weekly gain since early April, as investors juggled signs of tightening supply and persistent macro-economic concerns.

Brent futures traded near US$78 a barrel having closed 4.8 per cent higher last week following a pledge by Saudi Arabia and Russia to reduce supply. The market is flashing signs of strength and speculators have boosted their bullish bets for the global benchmark and West Texas Intermediate crude.

However, Treasury Secretary Janet Yellen said the risk of a U.S. recession is “not completely off the table,” adding an element of caution to the market. Data from China showed its economy is on the brink of deflation, while miner Rio Tinto Group said it sees a host of near-term economic challenges in the nation.

Oil remains about 9 per cent lower for the year due in part to China's lackluster economic recovery and aggressive monetary tightening by central banks. A solid US employment report keeps the Federal Reserve on track to boost interest rates this month, maintaining headwinds for crude prices. The International Energy Agency and OPEC will provide snapshots of the market when they release monthly reports later this week.

“The formula has remained the same: recession fears are still competing for dominance with a tight oil balance,” said Tamas Varga, an analyst at brokerage PVM Oil Associates.

Prices:

- Brent for September settlement slipped 0.7 per cent to US$77.94 a barrel at 10:29 a.m. in London.

- WTI for August delivery dipped 0.7 per cent to US$73.32 a barrel.

The U.S. announced on Friday that it's purchasing six million more barrels of crude for the Strategic Petroleum Reserve as the nation continues to slowly refill its supply buffer. The purchases, scheduled for October and November, come as the reserve is at its lowest point in 40 years.