Jul 30, 2022

Recession-Fueled Bond Rebound Faces Stern Tests Before Next FOMC

, Bloomberg News

(Bloomberg) -- Bond bulls, while savoring a stellar rebound in returns fueled by growing recession fears, are braced for potential setbacks.

With most Treasury yields back below 3% and the Federal Reserve expected to raise rates to at least that level by the end of the year to throttle inflation, bond investors need ongoing confirmation that Fed rate hikes are biting the economy. A bigger-than-expected drop in a key manufacturing gauge on July 1 ignited this month’s rally. The next reading is on Monday.

July employment data at the end of the week, by contrast, could be more troublesome as still-strong labor market conditions are the main basis for the Fed’s conviction that a recession can be avoided. There are more than 50 days until the US central bank’s next policy decision on Sept. 21, leaving lots of room for pivoting. The timespan includes the Fed’s often groundbreaking annual symposium in Jackson Hole, Wyoming on Aug. 25-26.

“The bottom line is that the Fed will be guided by the data on the ground,” said Margaret Kerins, global head of fixed-income strategy at BMO Capital Markets. “We have quite a bit of data coming before the next meeting, and the narrative may change. The Fed will continue to be nimble.”

The Fed and the market remain far apart on what’s likely to transpire next year. Swap contracts referencing Fed meeting dates this week moved to levels predicting additional hikes totaling about a percentage point this year, followed by rate cuts next year. Fed Chair Jerome Powell in remarks after this week’s Federal Open Market Committee meeting, while allowing that future increases might be smaller, said the further rate increases in 2023 that policy makers anticipated in June still represent its thinking. However he also said uncertainty about the policy path is abnormally high.

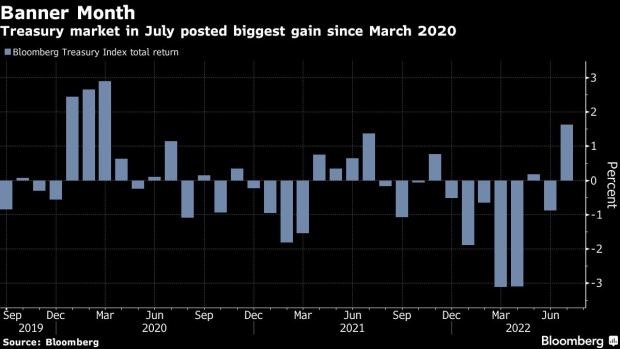

The Treasury market’s 1.6% July gain, its biggest since March 2000, was fueled by weakness in gauges of business activity, housing and consumer confidence. The benchmark 10-year note’s yield, which peaked in June near 3.50%, dipped below 2.64% on Friday, the lowest level since April 8. The previous day, the government’s initial estimate of 2Q GDP unexpectedly contracted.

The thinking is that the Fed’s four rate increases since March totaling 2.25 percentage points -- including this week’s 75-basis-point increase on Wednesday -- are sowing the seeds of economic malaise.

Shorter-term Treasury yields like the two-year, more directly influenced by the Fed’s rate, while also off their highest levels of the year, are higher than the 10-year by about 24 basis points. The inversion amounts to an expectation that the shorter-term yield will be lower by the time it matures.

Kerins’s team at BMO expects the 10-year to end the year at 2.5% and for the inversion between 2-year and 10-year yields to reach around 40 basis points.

Complicating price discovery in the Treasury market next week will be the quarterly announcement of note and bond auction sizes. While most dealers expect another round of cuts, they differ on the details.

Most agree, however, that seven-year note and 20-year bond auctions will undergo the biggest reductions in an effort to improve their performance in the market. The 20-year yield at around 3.21% Friday is the highest in the Treasury market, exceeding the 30-year bond’s by about 20 basis points.

“The 20-year point deserves special treatment given its acute illiquidity and extreme dislocation,” Bank of America Corp. strategists said in a note.

What to Watch

- Economic calendar

- Aug. 1: ISM and S&P Global manufacturing gauges; construction spending

- Aug. 2: JOLTS job openings; vehicle sales

- Aug. 3: ISM and S&P Global services gauges, factory orders; MBA mortgage applications

- Aug. 4: Jobless claims; trade balance; Challenger job cuts

- Aug 5: Employment report; consumer credit

- Fed calendar:

- Aug. 2: Chicago Fed President Charles Evans; New York Fed household debt and credit report; Cleveland Fed President Loretta Mester; St. Louis Fed President James Bullard;

- Aug. 4: Mester

- Auction calendar:

- Aug. 1: 13-, 26-week bills

- Aug. 4: 4-, 8-week bills

©2022 Bloomberg L.P.