Jul 29, 2022

Taiwan Joins Global Slowdown With Weakest Growth Since 2020

, Bloomberg News

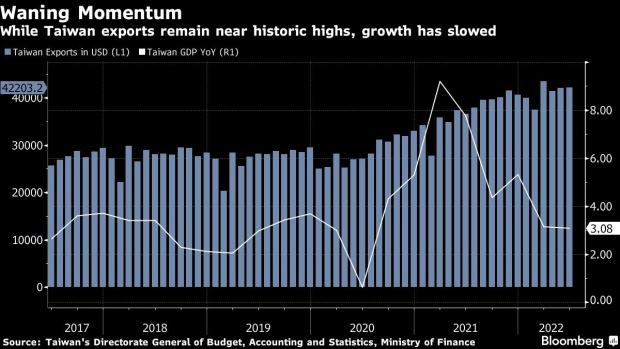

(Bloomberg) -- Taiwan lowered its unofficial economic outlook for the year as waning global demand for electronics and rising inflation slowed growth to the slowest pace in two years.

Gross domestic product rose 3.08% in the second quarter from a year earlier, down from 3.1% in the prior three months, official data showed Friday. That was lower than the 3.15% forecast in a Bloomberg survey of economists and the weakest since the second quarter of 2020.

Officials said full-year growth is likely to hit 3.85%, assuming previous estimates for the following quarters remain unchanged, falling short of the most recent formal estimate of 3.91%.

“Momentum is slowing,” said Ho Woei Chen, an economist with United Overseas Bank Ltd. in Singapore. “Growth contribution came mainly from gross capital formation, private consumption and government consumption. Net exports were negative to headline GDP.”

The slowdown comes after mounting warning signals from China and the US, Taiwan’s two largest export markets, which combined account for just over half of the island’s overseas shipments. An economic slowdown in the US has sparked recession talk as officials struggle to rein in the highest inflation in 40 years without cratering the economy.

The Chinese economy, meanwhile, has been weighed down by ongoing Covid outbreaks and resulting lockdowns, leading economists to downgrade their forecasts for growth in 2022 to 3.9% in a recent Bloomberg survey.

A string of poor results among major technology companies in the last few days added to the bearish outlook for Taiwan’s technology-reliant economy. Profits at Intel Corp. and Sony Group Corp. both missed estimates in the most recent quarter, with the companies downgrading future guidance.

Samsung Electronics Co. also warned of rising uncertainties in its outlook after reporting profit that missed estimates as cooling demand for consumer gadgets hit its chip division.

Factory data in Taiwan underscore the concerns about the broader economy. Manufacturing output grew just 0.51% in June, according to the Ministry of Economic Affairs, the weakest growth since January 2020.

The surging cost of imports also likely weighed on GDP. Taiwan’s trade balance fell to $11.9 billion in the second quarter, according to Finance Ministry data earlier this month, its lowest in over two years, as the rising costs of oil imports, exacerbated by a weakening currency, offset robust exports.

(Updated with additional details on outlook in third paragraph and chart.)

©2022 Bloomberg L.P.