Sep 17, 2022

Unrelenting Inflation, Tepid Sales Raise Curtain on Fed Meeting

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Inflation remains inexorable, retail sales are muddling along and manufacturing is struggling for momentum, an avalanche of economic data showed in the week before a pivotal Federal Reserve policy decision.

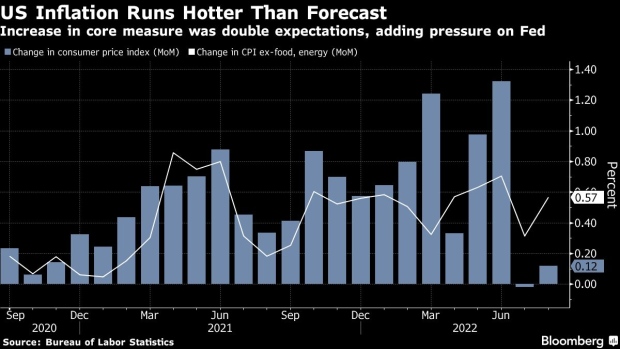

Consumer prices excluding food and energy jumped 0.6% in August -- twice as much as economists expected and double the previous month’s advance -- and will likely culminate in a third super-sized interest-rate hike by Fed officials next week.

Tuesday’s consumer price report was followed days later by figures showing widespread inflation is limiting Americans’ ability to spend on discretionary merchandise. At the same time, high prices have yet to cause an outright retrenchment as the labor market remains solid.

Retail sales, unadjusted for price changes, advanced 0.3% in August though the prior month was revised down to a 0.4% decline.

The data illustrate the many economic crosscurrents the Fed has to navigate as it attempts to extinguish inflation without tipping the economy into a recession.

Here’s a more detailed rundown of the latest reports on the state of the economy.

Inflation

The overall measure of consumer prices advanced last month, defying expectations for a monthly drop due to cheaper gasoline. Shelter, food and medical care were among the largest contributors to price growth, underscoring the breadth and severity of inflation with several categories posting record annual increases.

Read more: Inflation Surprise Puts Onus on Fed to Hit Brakes Even Harder

The government’s marquee inflation report was corroborated by other price data. The Atlanta Fed’s so-called sticky CPI measure rose 6.1% in August from a year ago, the biggest gain in 40 years. Meantime, the Cleveland Fed’s median CPI, which excludes categories with the largest price changes, increased by the most in data back to the early 1980s.

Finally, the Labor Department’s producer price index also showed a pickup in underlying inflation. The PPI minus food and energy rose a larger-than-forecast 0.4% last month and 7.3% from a year earlier.

Nonetheless, the report also showed an easing of pressures in the production pipeline. The costs of processed goods for intermediate demand minus food and energy dropped 0.8%, the steepest decline since April 2020.

Household Spending

The August gain in the total value of retail sales reflected increases in just over half of the 13 categories, but the July figure was worse than initially reported. And after stripping out some of the most volatile categories, like auto dealers, sales were little changed.

Together the figures paint a picture of sustained, albeit moderating, US demand for merchandise. Households are leaning on savings and rising wages to keep spending, though many families are feeling the pinch of widespread inflation.

Americans have been increasingly shifting spending more toward services and away from goods in a reversion toward pre-pandemic spending patterns. In Thursday’s report, sales at restaurants and bars -- the report’s only services category -- rebounded, which may portend solid spending in other service-sector categories like entertainment.

A fuller picture of spending in August, which includes both services spending and inflation-adjusted figures, will be released later this month. Still, in the wake of a sluggish core retail sales number, the Atlanta Fed’s GDPNow estimate of third-quarter growth took a notable hit.

Manufacturing

The Fed’s latest industrial production report showed a modest rise in factory output as resilient business investment more than offset a pullback in the output of consumer goods.

While domestic demand is generally holding up, manufacturers face a number of headwinds including the shift in consumer spending behavior toward services. That change in preferences caught some retailers flat-footed, leading to an inventory overhang and canceled orders that are further weighing on production.

Foreign demand is at risk of softening at well, as an energy crisis grips Europe, China’s economy cools and a surge in the value of dollar raises the costs of US goods for overseas customers.

Read more: FedEx Has Biggest Drop in Over 40 Years After Pulling Forecast

“With global manufacturing slumping due to the double whammy of zero-Covid lockdowns in China and rocketing energy prices in Europe, we expect any further gains in US manufacturing output over the coming months to be similarly muted,” Paul Ashworth, chief North America economist at Capital Economics, said in a note.

A pair of regional Fed bank surveys this week showed mixed results. A gauge of manufacturing in New York state snapped back in September, while, the Philadelphia Fed’s index contracted for the third time in four months.

©2022 Bloomberg L.P.