Jan 15, 2019

Betting S&P 500 will fall, traders shift cash into leveraged ETFs

, Bloomberg News

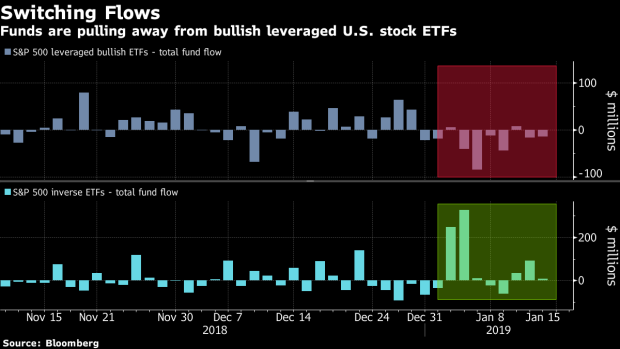

Investors are increasingly shifting bets that U.S. stocks will rise and flipping their cash into exchange-traded funds that profit when markets tumble.

About US$218 million has flowed out of bullish leveraged ETFs tracking the S&P 500 Index this year, even as the benchmark has rebounded from its worst month in almost a decade. Meanwhile, funds that capitalize on inverse movements in the benchmark have attracted almost three times that amount in inflows, putting them on course for their best month of asset gathering since July 2016, according to data compiled by Bloomberg.

The US$2.3 billion ProShares Short S&P 500 ETF took in US$380 million two weeks ago, its biggest weekly inflow since 2010. And investors have put money into triple-leveraged Direxion Daily S&P 500 Bear 3X Shares almost every day this year.

After coming within a hair of a bear market, the S&P 500 has rebounded near 10.5 per cent. But sentiment remains jittery as global economic data continue to worry investors, while uncertainties over the U.S.-China trade relation drag on.

“We had a really tough December and there may be that change in price momentum which retail investors may be responding to,” said Timothy Moe, chief Asia-Pacific equity strategist at Goldman Sachs Group Inc. It’s one indication of sentiment “if people are taking bets on a highly levered instrument, whether it’s a warrant, an option or a levered ETF.”

Anyone who bought into leveraged bullish ETFs last month felt some pain, as losses magnified in a volatile market. With 2018 having turned out to be a difficult year, strategists have pared their forward 12-month forecasts on the S&P 500. But they still see big gains coming, with a mean prediction of 2,906 for the benchmark by the end of the year -- a 12.5 per cent gain from Monday’s close.

Still, the reasons behind the moves in the ETFs may not be as clear as they seem. For example, traders could be using them to offset existing positions rather than for straight directional bets, according to Mark Tinker, head of Framlington Equities Asia at AXA Investment Managers in Hong Kong.

“I suspect that inverse ETF is a way of hedging a portfolio,” Tinker said. “For individuals it’s probably one of the few ways you can diversify and hedge.”