Jul 14, 2022

Biden Calls Inflation Numbers ‘Out of Date.’ Americans Disagree

, Bloomberg News

(Bloomberg) -- President Joe Biden is risking a disconnect with the American public, playing down inflation readings that have sown discontent with his handling of the US economy and unsettled a Federal Reserve his team says is key to taming prices.

The US saw the largest increase in consumer prices in more than 40 years last month, data showed Wednesday. Biden and his top economic advisers fanned out to say that the “unacceptably high” 9.1% annual inflation rate was “out of date” because it did not reflect the easing of gas prices since mid-June.

Fed officials took it differently. Federal Reserve Bank of Cleveland President Loretta Mester said she had “not seen any convincing evidence that inflation has turned the corner.” And Fed Board member Christopher Waller called the consumer-price index report a “major league disappointment.”

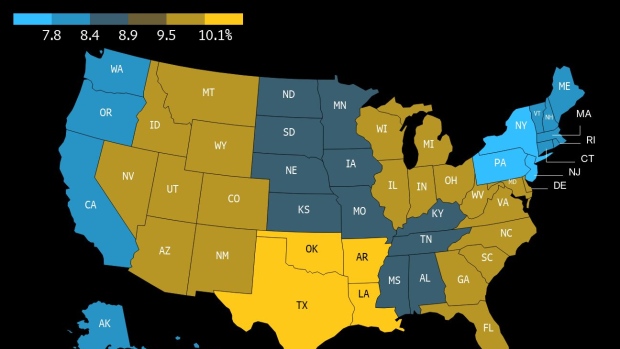

And there’s no relief in sight for Americans who’ve been seeing their real incomes dropping for more than a year now. Manufacturing workers have been especially hard hit, with one gauge of their buying power sliding to the lowest since mid-2014 -- an echo of the kind of malaise that tipped a string of old-line industrial states to Donald Trump in 2016, and an ominous data point ahead of November’s midterm elections.

As to Biden’s take on gasoline prices, while they have fallen steadily since mid-June, they remain roughly 46% more expensive on average than a year ago.

And even officials inside the administration acknowledge that any relief from the recent drop in pump prices won’t be enough to counter the rapid increase in rent and housing prices, which rose at an annual rate of 8.2% in the past three months. Food, meantime, has soared more than 10% the past year.

A Pew Research survey released this week showed just 13% of American adults say economic conditions in the US are excellent or good. And 56% say his policies have made economic conditions worse.

White House officials weren’t caught off guard by the inflation report, and economic aides sought to set expectations for a high number ahead of its release, according to a person familiar with the matter. But with few options at their disposal to address the cost-of-living surge, Biden’s team continues to point to the Fed as the key player.

Fed’s Role

“We’re first and foremost supportive of the Fed’s efforts and what they deem to be necessary to get inflation under control,” Treasury Secretary Janet Yellen said Thursday during a news conference in Indonesia.

Waller said Thursday that he favors a “huge” 75 basis-point interest-rate hike later this month, given the CPI numbers. Some investors expect the Fed could even boost its benchmark by 100 basis points at the July 26-27 policy meeting. Waller said his own vote would depend on further data.

But some analysts see the Fed as hamstrung in what it can do, owing to the way the war in Ukraine has affected global energy prices that have surged in the wake of Russia’s invasion of Ukraine.

“Energy is now politically weaponized,” said Derek Tang, an economist at LH Meyer in Washington. Because of that, “getting inflation down to where the public is at ease might be out of the Fed’s hands thanks to structural change in food and energy.”

In terms of fiscal measures, there are few options the Biden administration can turn to in order to bring down prices. Officials have blamed inflation on Russian President Vladimir Putin and on what they say are efforts by companies, especially in the energy industry, to profit from the moment.

“Our greatest challenge today comes from Russia’s illegal and unprovoked war against Ukraine,” Yellen said in Bali, where she’s meeting with Group of 20 finance ministers. “That was reflected in yesterday’s CPI data, which showed almost half of the increase coming from higher energy prices.”

She pointed to the US releases of oil from its Strategic Petroleum Reserve as one measure that has helped ease gasoline prices, but that a real victory would be if she could coordinate an agreement with allies to impose a price cap on Russian oil.

Yellen called that proposal “one of our most powerful tools to address the pain that Americans, and families across the world, are feeling at the gas pump and the grocery store right now.”

Yet the price-cap initiative remains riddled with complexities. For it to succeed, the US would need to reach agreement across the G-7 and the European Union. Yellen has also said she hopes that India and China would join, and that no decision has been made.

©2022 Bloomberg L.P.