Apr 11, 2024

Bitcoin Miners Power Up Rigs to Record Levels Ahead of ‘Halving’

, Bloomberg News

(Bloomberg) -- Bitcoin miners are generating more computing power than ever to mint the cryptocurrency ahead of a code adjustment within two weeks that will dramatically reduce revenue for the companies.

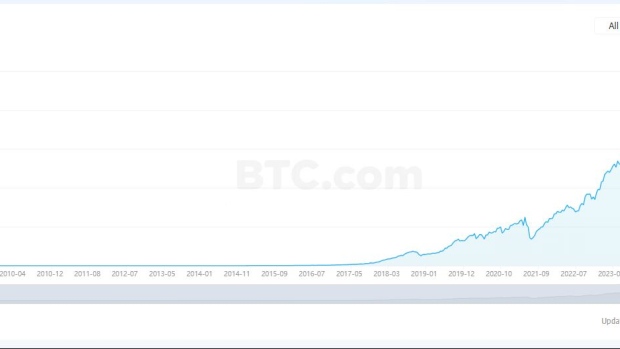

Mining difficulty, a measure of computing power to create fresh tokens, reached a record high on Wednesday. The latest bi-weekly update is the last reading before the “halving” set to take place on or around April 20. That figure has jumped by nearly 600% since the last halving in 2020, according to data compiled by btc.com, while the rate of energy consumption is seeing a rapid rise over the same period.

Called the halving, the anonymous Bitcoin creator or creators known as Satoshi Nakamoto pre-programed the event into the code of the original cryptocurrency to maintain the hard cap of 21 million tokens to keep it from becoming inflationary. The amount of new tokens, or Bitcoin rewards, issued to miners is reduced by 50% every four years.

That spells trouble for the miners since the vast majority of their revenue stems from the Bitcoin rewards. This month’s event is the fourth halving since 2012 and the reward will drop to 3.125 for the miners that successfully process a unit of transaction data on the blockchain. The daily production of coins from all miners will be down to 450 per day from 900.

Bitcoin mining companies are boosting their cash reserves to cope with the negative impact from the halving through a variety of channels including running their operations at full capacity or expanding them to produce and sell more coins amid soaring Bitcoin prices in the latest rally.

Shares of Marathon Digital Holdings Inc., the large publicly-traded miner, were little change at around $17.50 on Thursday. Smaller rival Riot Platforms Inc. was also little changed at about $9.86. Marathon has gained around 70% in the past year, while Riot has declined 20%.

©2024 Bloomberg L.P.