With about 14 per cent of Canadian mortgage holders set to renew their loans this year, the CEOs of the country’s big banks say they’re confident the resulting interest-rate hikes won’t crush customers or lead to a wave of defaults.

Several bank chief executive officers suggested Tuesday that customers can expect to pay somewhere in the range of $5,000 (US$3,700) more per year on average, but said Canadians are sitting on savings, earning higher wages and ready to slash their discretionary spending to avoid giving up their homes.

The executives, speaking at a conference in Toronto hosted by RBC Capital Markets, continued to strike a cautious tone on the Canadian economy and its prospects for a soft landing. But they also projected a decline in interest rates later this year, a factor that should work in the favor of the large majority of mortgage holders whose loans come up for renewal next year, in 2026 or after.

Royal Bank of Canada CEO Dave McKay said he “fully expects” that interest rates “will come down significantly by 2025 and 2026.” But in the meantime, he said, the lender’s customers who’ve already faced renewals have been able to absorb higher monthly costs — a trend that should continue this year.

For monthly payments in 2024, McKay said, “we expect roughly a $400 payment increase to the average mortgage holder in Canada.” That’s about the same as what borrowers saw last year when they renewed, and they’ve so far been able to handle the hikes “very well,” he said.

Bank of Nova Scotia CEO Scott Thomson said he expects his clients to see increases of $400 to $500 a month, while his counterpart at Canadian Imperial Bank of Commerce, Victor Dodig, said the hikes could be $300 to $700.

“I always like to remind everyone that clients do the calculation of keeping their home even though mortgage payments would increase on a monthly basis,” Dodig said, noting that legal fees and moving costs associated with selling a $1 million home could be in the range of $50,000 to $60,000.

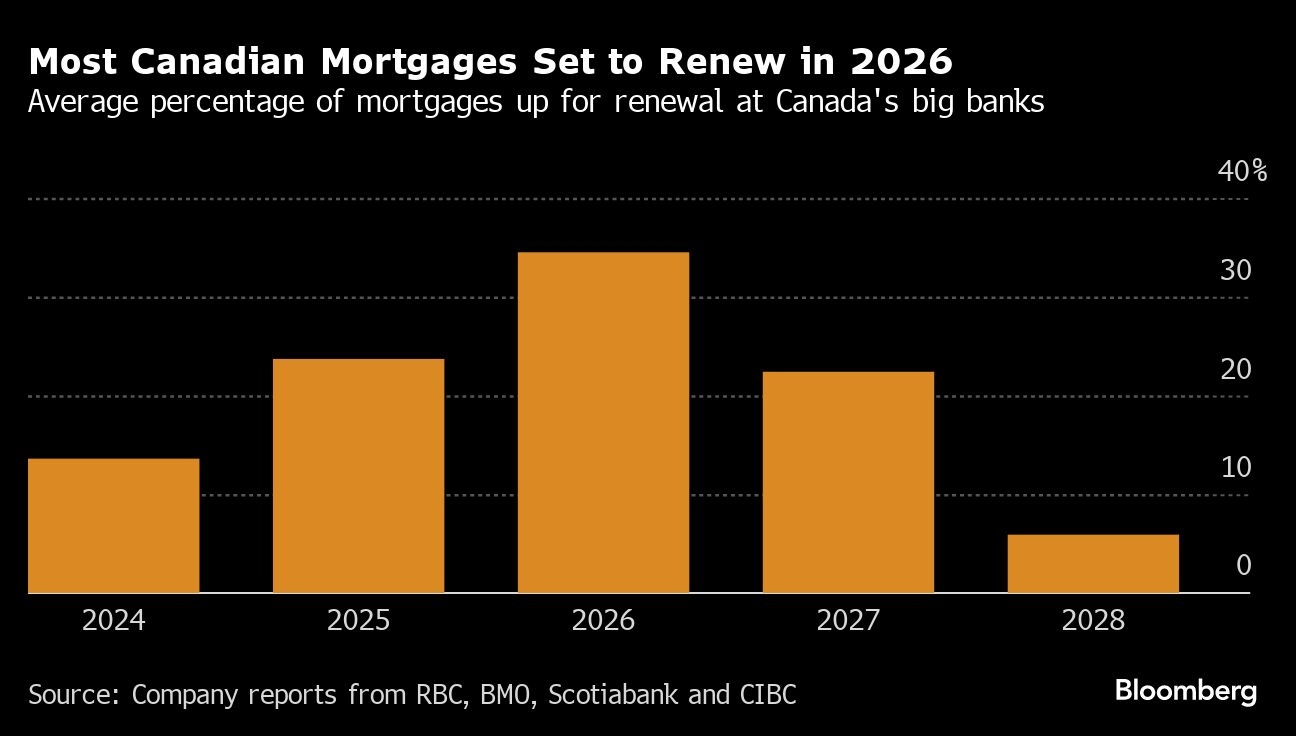

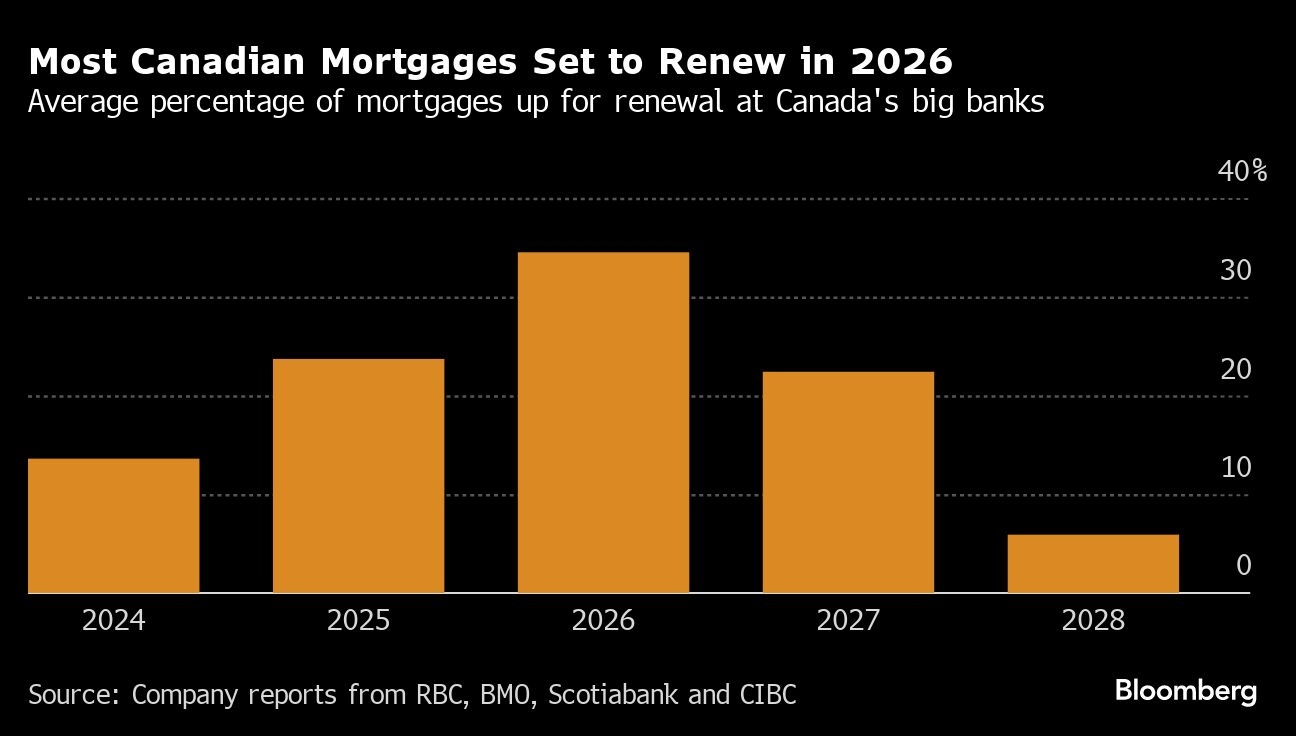

Canadian mortgages are typically signed for five-year terms. Next year, an average of about 24 per cent of home loans with the country’s biggest banks will be up for renewal, according to available disclosures from the firms’ most recent quarterly reports, which don’t include figures from Toronto-Dominion Bank and National Bank of Canada.

In 2026, an average of about 35 per cent of mortgages will be up for renewal, then about 22 per cent the following year. By that time, interest rates could have fallen significantly.

“One of the things that we’re certainly encountering now is a far, far lower level of concern with these mortgage renewals that are coming up, since the forward curve is implying that that rates are gonna go down,” RBC Capital Markets analyst Darko Mihelic said during his conversation with the Toronto-Dominion CEO Bharat Masrani.

Several of the CEOs offered forecasts on when the Bank of Canada and US Federal Reserve are likely to begin lowering interest rates and by how much. In general, they suggested rates could begin to fall around the middle of the year. Scotiabank’s Thomson said rates should come down by 75 basis points this year, while Bank of Montreal CEO Darryl White forecast a 100-basis-point drop. McKay said he expects a decline of 200 basis points by the end of 2025.