Apr 10, 2024

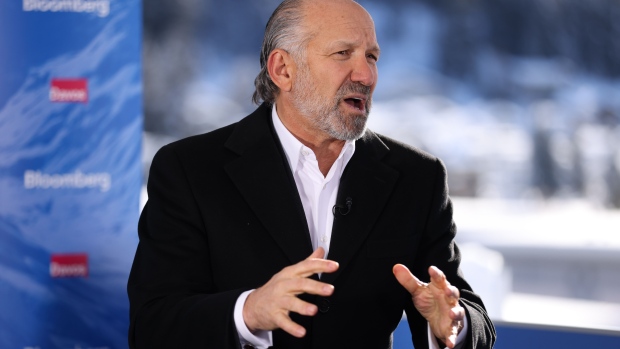

Cantor Fitzgerald’s Howard Lutnick Says Stablecoins Help to Support the Dollar

, Bloomberg News

(Bloomberg) -- Cantor Fitzgerald LP Chief Executive Officer Howard Lutnick said that crypto stablecoins are beneficial for the US economy and said that the tokenization of financial assets will likely increase.

“Dollar hegemony is fundamental to the United State of America. It matters to us, to our economy,” Lutnick said during a Chainalysis conference in New York on Wednesday. “That’s why I’m a fan of properly backed stablecoins. I’m a fan of Tether. I’m a fan of Circle.”

Cantor acts as a custodian for Tether Holdings Ltd., which is the largest issuer of stablecoins ahead of second-largest Circle Internet Financial Ltd. and its USDC token.

Tether’s USDT token serves as a foundation for much of the cryptocurrency market and has faced speculation for years that its coin wasn’t backed one-to-one with dollars as claimed. In January, Lutnick told Bloomberg TV his firm had confirmed Tether did in fact hold the money it says it does.

Read: Cantor Fitzgerald’s Lutnick Says Tether’s Reserves Do Exist

Stablecoins like Tether’s do not pose a systemic risk to the world, according to Lutnick. He added that these tokens drive demand for US Treasuries and are therefore “fundamental for the US economy”.

“It’s just an evolution. It’s better and it’s everywhere. And thank goodness,” he said.

By contrast, Lutnick voiced opposition to central bank digital currencies.

“My fear is that central banks would like to issue a central bank digital currency, that makes sense right?” he said. “But the problem is what will China think, they will define it as the American spy wallet.”

According to Lutnick, more so-called real-world assets such as bonds are likely to be traded on blockchains in what’s become known as tokenization.

Read: Why ‘Tokenizing’ Assets Is Turning Banks On to Crypto: QuickTake

“I think when proper blockchains, I mean blockchains that are fast and cheap, are available, I think you will see over the next 10 years, fundamental tokenization of financial assets,” Lutnick said.

Tokenization has been promoted heavily recently as one of the few viable use cases for blockchains. Financial heavyweights including BlackRock Inc., Brevan Howard, and KKR all have announced efforts to tokenize certain parts of funds. Citigroup has estimated the tokenization market could swell to $5 trillion by 2030.

Read: ‘Tokenized Hedge Fund’ Rakes in Crypto Billions With 37% Yield

(Added additional context from Lutnick comments about Tether’s reserves in January in the fourth paragraph and split fifth and sixth paragraphs)

©2024 Bloomberg L.P.