Sep 14, 2022

European Banks Are Getting Indirect Aid From Energy Backstops

, Bloomberg News

(Bloomberg) -- BNP Paribas SA, Commerzbank AG and ING Groep NV are emerging as major indirect beneficiaries of the backstops given by European governments to energy companies, with the aid helping stave off a potential wave of defaults.

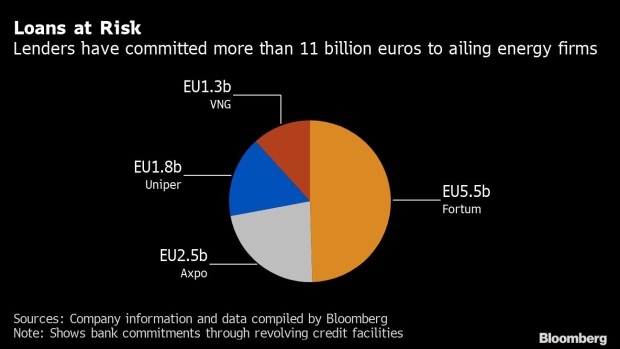

Those banks are the only ones to have extended revolving credit lines to all four energy companies that have received state aid, including Germany’s Uniper SE, according to data compiled by Bloomberg. Together, a total of about 30 lenders have committed financing worth some 11 billion euros ($11 billion) to the troubled firms.

As the region’s governments have made tens of billions of euros available in recent weeks to energy firms hit by price spikes due to Russia’s curtailing of gas supplies, the sector’s bankers face less need to put cash aside against expected defaults. The German government is even open to nationalizing Uniper, Bloomberg reported Wednesday, underlining the extent to which the energy sector is seen as too-important-to-fail.

“The governments cannot allow the bankruptcy of any energy companies at this point,” said Elisabeth Rudman who heads DBRS Ratings’ financial institutions group in Europe. “During coronavirus, the government measures were incredibly supportive of the economy and therefore banks.”

Representatives for BNP Paribas, Commerzbank, and ING declined to comment.

The region’s bank watchdogs are taking note, though have yet to signal any intention to weigh in on the extent to which lenders pay out dividends to investors even while their profitability is being shored up by implicit government support. During the pandemic, the European Central Bank restricted the extent to which lenders could return capital, in recognition of the regulatory flexibility they had been given.

Last month the ECB wrote to banks it oversees, telling them to analyze the impact of a gas stoppage on their businesses, Bloomberg reported last week. Responses are due in mid-September, and follow-up conversations are to come by the end of this month.

Read More: ECB Ramps Up Scrutiny of Banks’ Response to Energy Crisis

The exact amount of exposure to the energy firms is not clear, as the companies have not disclosed the amount of credit drawn down. The full list of lenders includes Citigroup Inc., Deutsche Bank AG, Goldman Sachs Group Inc, Morgan Stanley, Societe Generale SA and UniCredit SpA according to information provided by the borrowing companies.

Axpo Holding AG’s credit line was only signed in February this year, just before Russia’s invasion of Ukraine. The Swiss utility group was granted a government backstop of as much as 4 billion Swiss francs ($4.2 billion) in early September, as margin calls across the energy trading sector surged.

The VNG AG and Fortum Oyj deals are even more recent as they received new loan arrangements in June, when the energy crisis had already begun. Uniper revealed at the end of that month that it was in bailout talks with the German government.

Commerzbank Chief Executive Officer Manfred Knof recently confirmed guidance given before the energy crisis that the lender will achieve net income of more than 1 billion euros this year and said that government aid to companies plays a big role in the benign outlook. The bank is a top lender to Uniper and a member of the lending consortia to Axpo, Fortum and VNG.

Austria’s Wien Energie GmbH also received a 2 billion euro loan from its government, although there’s no evidence banks have exposure through revolving credit facilities.

Potential Losses

Investors are currently sizing up the extent to which exposure to the energy sector could result in losses, in a worst-case scenario. Analysts at Keefe, Bruyette & Woods wrote in a note last week that cumulative loan losses for European banks could double in the event of a 3 percentage-points reduction in economic output over the next three years. Government backstops make that outcome unlikely, they said.

In addition to the considerations over Uniper, the German government is set to use loan authorizations worth some 67 billion euros already created during the coronavirus pandemic to extend support to the energy sector, Bloomberg reported on Tuesday.

It’s not yet clear what banks will be expected to do in response to the government largess but in some European countries, such as Spain, a debate over the ‘windfall profits’ of banks and energy companies is already advanced.

Read More: Spanish Premier Says Botin Griping at Bank Tax Shows He’s Right

©2022 Bloomberg L.P.