Jan 11, 2023

Housing-Market Funk Has Lumber Traders Expecting Rally to Fizzle

, Bloomberg News

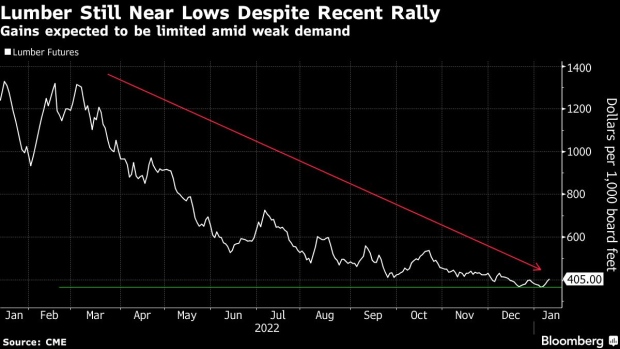

(Bloomberg) -- The chill in North America’s housing market has lumber traders saying the commodity’s recent rally may not have much more room to run.

Benchmark futures in Chicago rose as much as 5% to $423 per 1,000 board feet Thursday — the highest price in a month — heading for the longest rally in two weeks. The bounce comes after prices slumped to the lowest in more than two years last week.

While major producers are slashing production, buyers are still spooked by rising interest rates and passing up cheap supplies, meaning any price recovery is “not going to go very far,” said Russ Taylor, president of Russ Taylor Global in Vancouver.

“It’s more like crickets lately,” said Charlie Thorpe, a commodities trader at Olympic Industries in North Vancouver. “It’s been tough slogging for sales.”

Lumber’s plunge, which made it the worst-performing commodity last year, marked a dramatic reversal from the all-time highs set in 2021, when tight supplies were snapped up by shut-in North Americans who were building or renovating homes during pandemic lockdowns.

Canadian producers West Fraser Timber Co. and Canfor Corp. already have announced output reductions from British Columbia sawmills this year, and further curtailments are expected, said John Cooney, an analyst with ERA Forest Products Research. US homebuilders buy more than a quarter of their lumber from Canada.

“Homebuilders have all battened down the hatches,” Cooney said in an interview. “I think there’s a couple of quarters of pain coming up.”

Rising interest rates are having a negative effect on the North American housing market, and rates are expected to rise for most of 2023 as the Federal Reserve tries to suppress inflation, RBC Capital Markets analyst Paul Quinn said in a note.

A rate cut toward the end of this year would be too late to save the home-building season, and the difficult year will likely prompt a number of permanent capacity reductions, he said.

A glut of European lumber has increased supplies in North America despite the production cuts, and wood inventories remain high, Olympic Industries’ Thorpe said. The market has shifted from extreme volatility to “flat,” he said.

“If anything, we’re back to the mean, which is grinding for the order, fighting for minimal margin,” Thorpe said. “I can actually sit at a table and eat my lunch. I’m not shoveling in bites standing at my desk.”

(Updates lumber prices in second paragraph)

©2023 Bloomberg L.P.