Apr 16, 2024

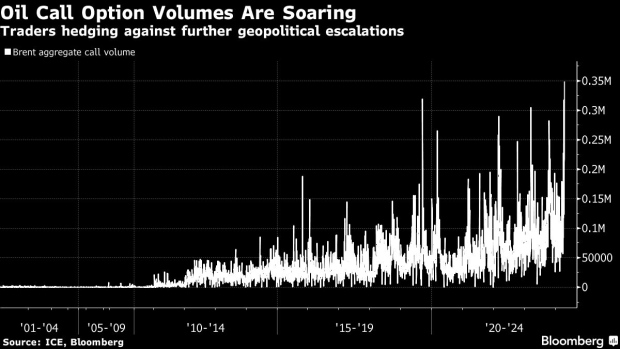

Trading in Bullish Oil Options Hits Record After Iran’s Attack

, Bloomberg News

(Bloomberg) -- Volumes of bullish oil options surged to a record after Israel vowed to respond to Iran’s weekend missile and drone attack.

Almost 350,000 calls on Brent crude traded Monday, eclipsing the previous record set in 2019. Those contracts also deepened their premium over bearish puts to the biggest since October as Israel flagged its intention to strike back.

Much of the trading was centered around the buying of new bullish positions, and rolling some of the existing contracts that were opened in the weeks before Iran’s bombardment, according to people involved in the market. Open interest figures showed an increase.

Traders have turned to the oil options market to secure exposure to the risk of higher oil prices in the event of any escalation in the Middle East conflict that disrupts supplies. Brent futures have rallied to about $90 a barrel as a result of the ongoing turmoil in the region, which alongside robust consumption and tight supplies have propelled prices to a five-month high.

©2024 Bloomberg L.P.