Feb 13, 2023

Bank of Japan Policy Outlook Has Yen Volatility Overtaking Peers

, Bloomberg News

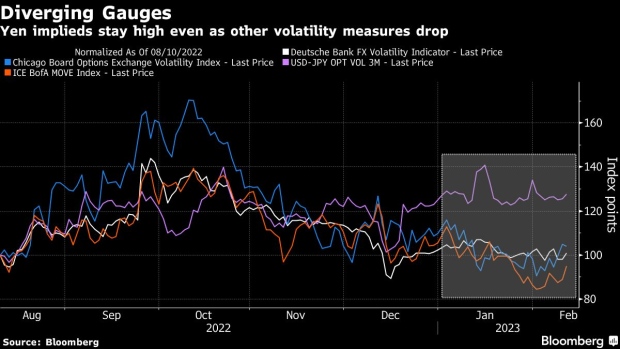

(Bloomberg) -- The Japanese yen is not taking part in the great moderation.

Forward-looking measures of equity and bond volatility around the world have been largely sliding this year on hopes that China’s reopening and disinflation will help the global economy navigate a soft landing.

But Japan’s currency is resisting the urge to join in on a period of relative calm. Volatility has stayed high ever since the Bank of Japan lifted the cap on Japanese bond yields in December. Uncertainty about the outlook of future policy moves is keeping yen traders on edge more so than their counterparts who trade other global assets, including Japanese equities.

The yen initially strengthened Friday after a report that Japanese Prime Minister Fumio Kishida will nominate Kazuo Ueda to take the helm of the central bank. Those gains quickly evaporated after Ueda told local media that the BOJ’s stimulus should stay in place.

The reasons for Kishida’s choice of governor and the central bank’s ultimate policy stance will become clearer once official selections are made this week. Until then, yen volatility is holding firm. On Friday, traders were accumulating options expiring around upcoming central bank meetings to capture any future policy shifts or pronouncements. And Kuroda is set to exit in April.

There is good reason for yen traders to be nervous. The Japanese currency soared the most since 1998 after the BOJ’s December move triggered fears that Japanese investors will further offload overseas debt in favor of local holdings. Ministry of Finance data shows these investors sold a record amount of overseas bonds last year amid a combination of higher hedging costs and speculation the BOJ would normalize policy.

There are also signs that unexpected Bank of Japan tightening can disrupt lucrative returns on hedged foreign holdings of Japanese T-bills. Overseas investors hold a whopping 64% of Japan’s treasury bill market or about ¥95 trillion ($724 billion) as of the end of September, according to the latest data.

Hedging these holdings using a rolling three-month currency swap can transform a negative-yielding Japanese bill into an expected rate of return of more than 5% for dollar holders and 3% for euro holders.

Should Ueda follow other central bankers and choose to hike policy rates rather than cut the balance sheet to slow inflation, losses would likely be incurred on both underlying bill holdings as well as corresponding currency hedges if the yen appreciates. In this sense, it may not be a coincidence that the selling by foreign accounts of a record ¥4.9 trillion of Japanese bonds in the third week of December was accompanied by outsized yen gains.

Traders are also closely watching the forces of inflation outside Japan, keeping dollar-yen volatility around this week’s US inflation data elevated. With speculative positioning in the pair largely whittled down over the past month, any unexpected outcomes could rile calm markets.

©2023 Bloomberg L.P.