Nov 15, 2016

Fed's Fischer says not concerned U.S. markets lack liquidity

, Reuters

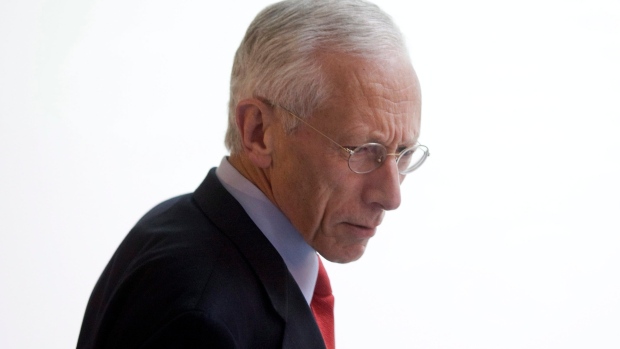

WASHINGTON - U.S. banking rules may be limiting liquidity for some securities but their impact is not unduly hurting markets, Federal Reserve Vice Chair Stanley Fischer said on Tuesday.

Since the 2008 financial crisis, leading banks have had to hold more capital to brace for a future shock and those rules might be weighing on markets, Fischer said.

Even so, those effects might be worthwhile if the rules help shield markets from a future financial upheaval, he said.

"This perspective naturally emphasizes potential tradeoffs between the possibly adverse effect regulations may have on market liquidity and their positive effect on the stability of the financial system," Fischer told a Brookings Institution conference on market liquidity.

Leaders of the U.S. banking industry have argued that they could boost the economy and offer more consumer credit if some capital rules were eased.