Nov 1, 2018

Keith Richard's Top Picks: Nov. 1, 2018

Keith Richards, president and chief portfolio manager at ValueTrend Wealth Management

Focus: Technical analysis

MARKET OUTLOOK

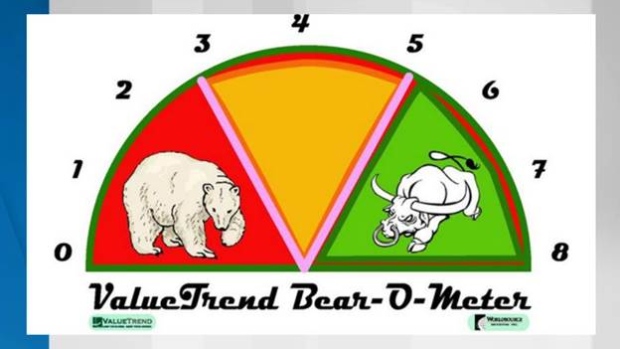

What a difference a month makes. On my last Bear-o-meter reading taken on Oct. 3, we got a decisive “high-risk” reading of one. As many of the BNN Bloomberg watchers who follow my blog might know, the Bear-o-meter is a compilation of 11 indicators that are assigned bullish, neutral or bearish numeral values. These values are tallied, and the Bear-o-meter is ranked from zero to eight. You can see this ranking and the respective positioning in the three sections on the following diagram:

The three sections are classified as lower risk, balanced risk and higher risk. As of Monday morning, the Bear-o-meter has moved to a ranking of four. This reading, while not outright bullish (it’s neutral), is a far cry better than the deeply bearish reading of one we got a month ago. A rebound over a few days that moves the S&P 500 over its 200-day simple moving average would be my buy signal. The 200 -day is sitting at around 2,760, while as I write this, the S&P 500 is sitting around 2,700. That would push the Bear-o-meter up by two points (assuming all other factors remain in similar positions) – creating an outright bullish signal. Better to wait for the buy signal and buy higher than risk predicting a market bottom only to watch further deterioration. As I note regarding my Bear-o-meter reading, we’re in a neutral risk/reward position right now. That’s encouraging, but I need that final signal before I become a buyer.

TOP PICKS

ORACLE CORP (ORCL.O)

Oracle is trading range-bound, near the bottom of the range. It was less volatile than the FAANGs and chips during the meltdown.

MICROSOFT (MSFT.O)

Still in its uptrend, Microsoft pulled back to the 200-day moving average. No signs of the trend breaking.

FAIRFAX FINANCIAL (FFH.TO)

This stock has a history of going from the low $600s to the high $700s, then falling right back to repeat the process. We’re in the low end of that trading range, which is where we bought it. We suspect this is a great entry point.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| ORCL | Y | Y | Y |

| MSFT | Y | Y | Y |

| FFH | Y | Y | Y |

PAST PICKS: AUG. 23, 2018

MANULIFE (MFC.TO)

- Then: $23.95

- Now: $20.80

- Return: -13%

- Total return: -13%

SCOTIABANK (BNS.TO)

- Then: $77.92

- Now: $70.73

- Return: -9%

- Total return: -8%

CASH

We’ve held over 20 per cent cash since May and have noted that on the show in the past. Now is the time to start deploying that cash as per my commentary today.

Total return average: -7%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| MFC | Y | Y | Y |

| BNS | Y | Y | Y |

WEBSITE: www.valuetrend.ca