Apr 3, 2023

Oil surges most in a year after OPEC+'s shocking production cut

, Bloomberg News

We might not like it, but OPEC+ 'surprise cut' makes sense: Strategist

Oil rallied the most in more than a year after OPEC+ unexpectedly announced output cuts that threaten to tighten the market and deliver a fresh inflationary jolt to the world economy.

The Organization of Petroleum Exporting Countries and allies, including Russia, pledged to make cuts exceeding 1 million barrels a day starting next month and lasting through the end of the year. The reduction surprised markets, which had expected the cartel to hold output steady. Adding to the shock, the decision came outside of the group’s scheduled timetable for reviewing the market’s demand and member’s supplies.

The decision quickly rippled across global oil markets. WTI’s prompt-spread flipped into backwardation for the first time since December, signaling renewed strength as traders see demand outstripping supply. Goldman Sachs Group Inc. lifted price forecasts for this year and 2024 and U.S. gasoline futures also surged, underscoring inflationary risks.

“OPEC+ shows commitment to protecting against the downside,” said Nadia Martin Wiggen, a partner at Pareto Securities. “The duration of the cut is the most surprising and bullish part.”

Before the surprise intervention, crude had capped a 5.7 per cent quarterly drop amid banking-sector turmoil and recession risks. Many market watchers had expected a rebound in the second half, underpinned by rising demand in China. Bucking Wall Street’s spate of higher calls in the wake of the decision, Morgan Stanley noted China’s demand growth has lagged expectations and lowered its price forecast.

AMERICA’S RESPONSE

The White House said the OPEC+ decision was ill-advised, while adding the U.S. would work with producers and consumers to contain gasoline prices. With the U.S. driving season around the corner, the cartel’s cut could add more than 50 cents a gallon to the national average of pump prices. Last year faced with skyrocketing prices after Russia’s invasion of Ukraine, President Joe Biden ordered an unprecedentedly large release from the nation’s strategic crude reserves.

Costlier crude threatens to add to inflation, complicating central banks’ efforts to tame persistent price pressures. The U.S. Federal Reserve raised interest rates again last month, and officials are next scheduled to meet in May to set monetary policy.

Prices:

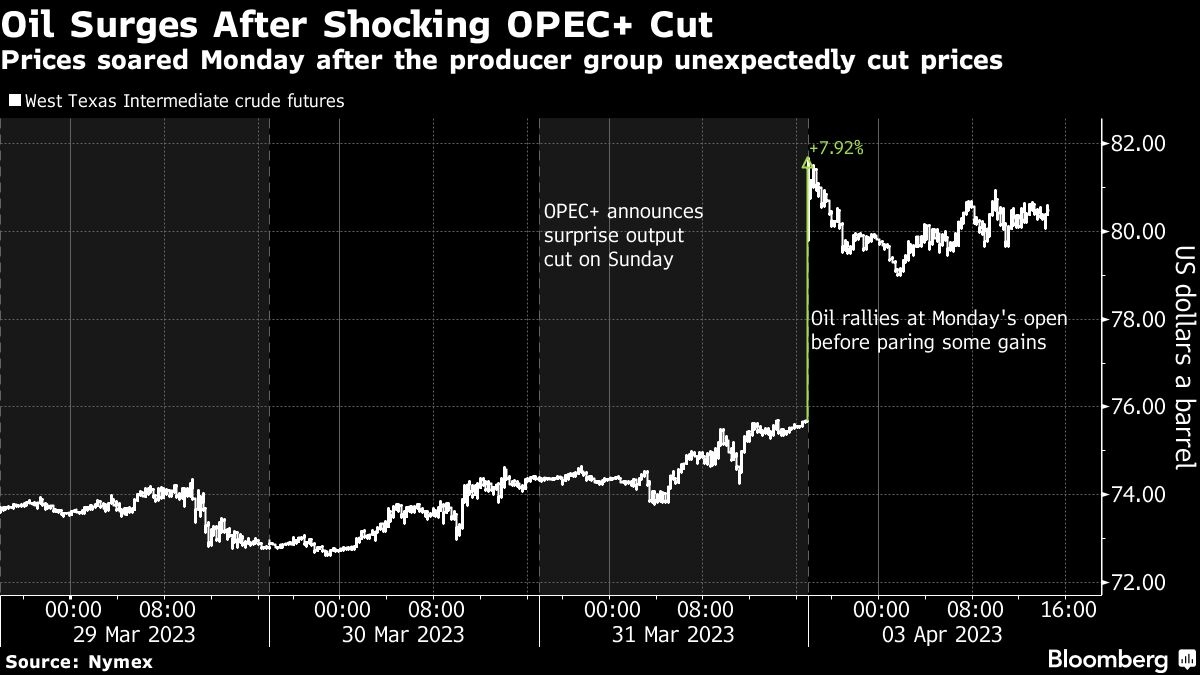

- WTI for May delivery rose US$4.75 to US$80.42 a barrel at 2:30 p.m. in New York.

- Futures rallied by as much as 8 per cent earlier, the biggest intraday increase since March 2022.

- Brent for June settlement gained US$5.16 to US$84.93 a barrel.