Feb 15, 2023

US Retail Sales Jump by Most in Nearly Two Years in Broad Gain

, Bloomberg News

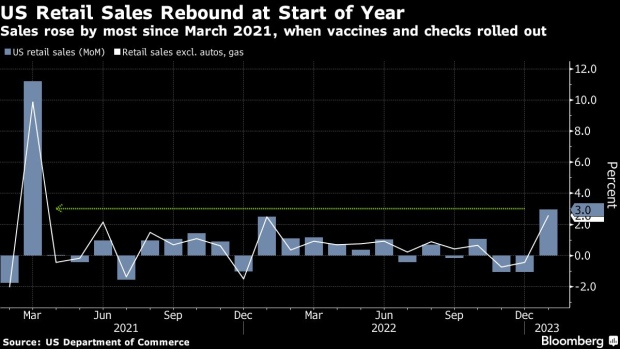

(Bloomberg) -- US retail sales rose in January by the most in nearly two years, signaling robust consumer demand that could bolster the Federal Reserve’s resolve to keep raising interest rates in the face of persistent inflation.

The value of overall retail purchases increased 3% in a broad advance — the most since March 2021 — after a 1.1% drop in the prior month, Commerce Department data showed Wednesday. Excluding gasoline and autos, retail sales rose 2.6%, also the biggest increase in nearly two years. The figures aren’t adjusted for inflation.

The total retail sales figure matched the highest estimate in a Bloomberg survey of economists, which had a median forecast of 2%.

All 13 retail categories rose last month, led by motor vehicles, furniture and restaurants. The report showed vehicle sales climbed 5.9% in January, also the most in nearly two years. The value of sales at gasoline stations were essentially unchanged.

The report showed US consumers got off to a good start in 2023, rebounding from a spending slowdown at the end of last year. A resilient labor market marked by historically low unemployment and solid wage gains has allowed many Americans to keep spending on goods and services even as borrowing costs rise and inflation remains elevated.

Read more: US Consumer Spending Ticks Up Amid Strong Wages, BofA Says

The data follow a report Tuesday that showed US consumer prices rose briskly at the start of the year — including in many goods categories like clothing and household furnishings — prompting several Fed officials to suggest that interest rates may need to go even higher than expected to quash persistent inflationary pressures.

What Bloomberg Economics Says...

“With the disinflation process stalling and the economy showing only limited signs of softening, the strong retail-sales data suggest the Fed will need to keep rates high for longer — with a growing risk of a higher peak fed funds rate.”

— Eliza Winger, economist

To read the full note, click here

The S&P 500 Index declined and Treasury yields rose, suggesting traders are pricing in more aggressive Fed policy. Separate reports published Wednesday suggest that the economy is off a solid start this year: US factory production rose by the most in nearly a year last month, suggesting improving supply chains and firmer demand, and New York state manufacturing activity shrank less than forecast in February for a third month.

Still, the retail sales report can be difficult to draw concrete conclusions from since the data aren’t adjusted for inflation and mostly only capture spending on goods. A report on January household demand that includes price-adjusted goods and services spending is due later this month.

Sales at restaurants and bars — the only service-sector category in the report — increased 7.2% in January. That was also the most since March 2021, when vaccines were rolling out and Americans took advantage of a fresh wave of stimulus payments.

Read more: Jobs Galore Give US Consumers Firepower to Fight Off Recession

How Executives See It

- “During the fourth quarter, the environment remained dynamic, as inflation geopolitical tensions, pandemic-related mobility restrictions and currency volatility persisted. Despite this range of factors, consumer demand held up relatively well and our industry remains strong.” — James Quincey, Coca-Cola Co. CEO, Feb. 14 earnings call

- “We serve an estimated one-fifth of US protein consumption, and we’re well-positioned to meet consumer demand, which remained steady despite challenging macroeconomic environment with ongoing elevated levels of inflation.” Donnie King, Tyson Foods Inc. CEO, Feb. 6 earnings call

- “Business continued to be impacted by tough operating environment, including slowing consumer demand for general merchandise categories as well as inventory reductions at retail.” Ravi Saligram, Newell Brands Inc. CEO, Feb. 10 earnings call

So-called control group sales — which are used to calculate gross domestic product and exclude food services, auto dealers, building materials stores and gasoline stations — climbed 1.7%, the most in a year.

“What we see here is that the US consumer is still spending despite stories of its untimely demise,” Alex Pelle, US economist at Mizuho, said in a note. The figures suggest “that the US economy is not slowing much and is still likely growing above trend.”

--With assistance from Jordan Yadoo and Reade Pickert.

(Adds economist’s comment and updates trading)

©2023 Bloomberg L.P.