Dec 28, 2018

U.S. stocks fall as volatility rules in wild week

, Bloomberg News

U.S. stocks halted a two-day rally as thin trading added to already-volatile markets ahead of the weekend. Treasuries rose.

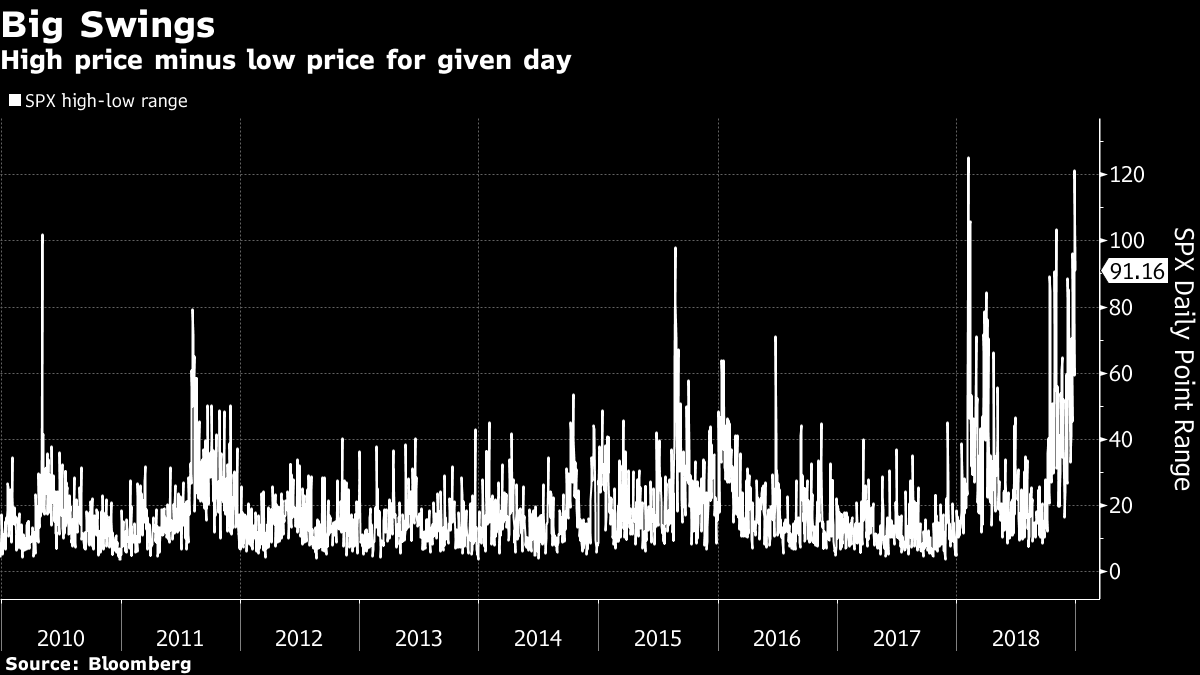

The S&P 500 ended the session lower, but held onto its first weekly gain in a month. Trading was still volatile after a roller-coaster session Thursday that saw the biggest reversal since 2010. The holiday-shortened week began with the worst pre-Christmas day on record before stocks notched the biggest one-day surge in almost a decade. The benchmark is on track for its worst year of the bull market.

“You’re in a period of high unknown right now,” Jeremy Bryan, portfolio manager at Gradient Investments, said in an interview. “It’s the market trying to find bottoms and trying to find its footing. That’s why we’re seeing such volatile swings in this tape. It’s just right now there seems to be a lot more consternation, which is why you’re seeing markets reacting violently both ways.”

Global stocks are set for the worst year since 2008 and oil is mired in its steepest quarterly slump since 2014. Plenty of event risks loom in the coming year, from the U.K. vote on the Brexit deal to U.S.-China trade talks to the continuing showdown between President Donald Trump and Congress over the budget.

“We’re heading into a period of higher volatility,” said Manpreet Gill, head of fixed income, currency and commodities strategy at Standard Chartered Plc in Singapore. “You need to have some dry powder on the side to take advantage of that. That’s where we particularly think that cash plays a bit of a role.”

In Europe, the Stoxx 600 saw its largest one-day rally since April. Japanese shares declined, while stocks in China saw modest advances. Japanese 10-year yields dipped below zero. West Texas intermediate crude bounced with emerging market equities.

Japan and China had their final trading day of the year Friday. Aside from any further developments on the American political front -- where departures of senior officials and tensions at the White House over the Federal Reserve have unsettled investors, upcoming manufacturing PMIs from China and the U.S. may be a focus in the coming week.

Here’s a look at how some key assets have done this year:

The S&P 500 is down 7.5 per cent Japan’s Topix is down 18 per cent The Stoxx Europe 600 is down almost 14 per cent The MSCI Emerging Markets Index dropped about 16 per cent The Bloomberg Dollar Spot Index rose more than 3 per cent The Bloomberg Commodity Index fell almost 12 per cent

Here are some events investors may focus on in coming days:

China releases its official PMIs on Monday, the last day of 2018. Brazil’s new president is sworn in on Tuesday. The U.S. ISM manufacturing PMI is due Friday, Jan. 4.

And these are the main moves in markets:

Stocks

The S&P 500 Index fell 0.1 per cent as of 4 p.m. in New York. The Stoxx Europe 600 Index jumped 2 per cent, the biggest surge in about nine months. The MSCI All-Country World Index increased 1.2 per cent. The MSCI Emerging Market Index increased 1.2 per cent to the highest in more than a week.

Currencies

The Bloomberg Dollar Spot Index dipped 0.2 per cent. The euro climbed 0.1 per cent to US$1.1442. The Japanese yen jumped 0.6 per cent to 110.40 per dollar. The British pound advanced 0.4 per cent to US$1.2692. The MSCI Emerging Markets Currency Index gained 0.3 per cent to the highest in more than three weeks.

Bonds

The yield on 10-year Treasuries dipped three basis points to 2.74 per cent. Germany’s 10-year yield one basis point to 0.24 per cent, the largest gain in a week. Britain’s 10-year yield fell four basis points to 1.269 per cent.

Commodities

The Bloomberg Commodity Index decreased 0.3 per cent. West Texas Intermediate crude gained 1.7 per cent to US$45.38 a barrel. Gold was little changed at US$1,281.50 an ounce.